Weekly Market Review & Analysis For March 14, 2022

The S&P 500 market increased 6.2% for the week, which followed a four-day winning streak since the market was more inclined to view economic and geopolitical issues positively. Small-cap Russell 2000 index with +5.4% and the Dow Jones Industrial Average with +5.5% climbed over 5.0%, while the heavily loaded technology stocks Nasdaq Composite soared with an 8.2% increase.

Ten of eleven S&P 500 market sectors ended up higher, with nine sectors increasing between 2.7% posting by real estate and 9.3% by consumer discretionary sector. The only loser was the energy sector, posting -3.6% for the week.

There was no single trigger to activate the market's rise. Instead, it was a swarm of events that helped revive the market's spirits. These including:

- Crude oil prices forfeiting 5.6%

- Fed Chair Jerome Powell was declaring that the chance of a recession occurring within the next year is low.

- Early news indicating ceasefire talks between Russia and Ukraine.

- China promises support for its markets and economy.

- The PPI (Producer Price Index) for February rising "just" 0.8% month-over-month.

- Much higher revenue posting for Q1 coming from Delta Airlines (DAL), United Airlines (UAL) as well as Southwest Airlines (LUV).

To denote the positive news:

- Crude oil prices reached $100/bbl for the week $103.03/bbl, down -6.07, or -5.6% after falling below $94.00/bbl on Tuesday.

- Fed Chair Jerome Powell acknowledged that monetary policy may impact economic growth in 2023 and 2024.

- Russia has disputed ceasefire progress talks and continued its cleansing campaign

- China has administered a week-long Covid lockdown on Shenzhen, a crucial technology hub that could cause global supply chain problems.

- The Producer Price Index nevertheless was still at 10% year-over-year

- The airline's companies continued forecasting revenues to be lower than pre-pandemic levels

Another plausible explanation for the market rally was that the market expected a technical rebound. The bearish mood prevalent during the week formed the foundation of S&P 500 of our Mean Sup 4170 for the massive rise. There have been short-covering that was in the mix.

Concerning the Fed's meeting regarding the monetary policy, the central bank raised the interest rate for the federal fund rate by 25 basis points to a target range of 0.25-0.50 - this was in line with expectations. It also announced six possible additional rate increases this year. Chair Powell stated that the Fed might begin to reduce the balance sheet after the policy meeting in May.

The U.S. Treasury market underwent some curve-flattening yield movement with shorter-dated interest rates outstripping the climb in longer-dated interest rates. The Two-yr yield climbed 21 basis points to close at 1.96%, and the Ten-yr yield increased 15 basis points to finish at 2.15%.

European market finished higher as the imposter Biden with Xi discussions were in central focus, while Asia-Pacific region finished out a hectic week's session mostly higher. The Eurodollar was lower against the U.S. Dollar, while the British Pound was higher against the U.S. Dollar. The bond yields in both Europe and the United Kingdom tumbled.

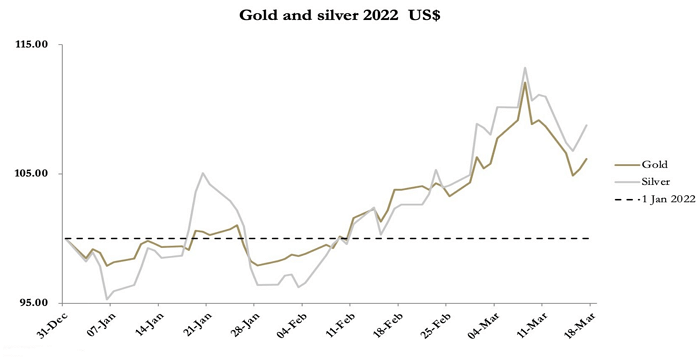

Gold and Silver market

After the primary commodities market topped last week's trading session and sold off severely this week, we witnessed a continuation of tumbling prices before stabilizing on Wednesday's session. Gold settled at $1,921 on Friday's session, down $67 from last Friday's close in the wake of a low point of $1,895 on Wednesday. The silver metal traded at $24.94, down 91 cents, having touched $24.47 for the same period.

Cryptocurrency

It was a week full of crucial decisions. The crypto sector has been officially legalized in Ukraine, and bitcoiners did breathe a sigh of relief following a recent vote by the European Parliament. Furthermore, bitcoin is keeping the crypto market in suspense. When will the price finally break out to Key Res $44,400? - Stay tuned.

This article was printed from TradingSig.com