How to Survive the Final Bitcoin Shakeout of 2024

Authored by: Houston Molnar

A few years ago, asset manager Fidelity reportedly studied investor behavior. And the results shocked everyone. It found the best-performing accounts belonged to people who had forgotten they had an account or – even crazier – had passed away.

The study proved the best way to build wealth from the markets is to invest in high-quality companies and hold them for the long term. Traders who thought they could outsmart the market by moving in and out of stocks generally found themselves underperforming the market.

Today, the study is considered an urban legend by many. But like all legends, there's a kernel of truth embedded within.

According to a study by the prestigious Wharton School at the University of Pennsylvania, active fund managers (those who buy and sell handpicked stocks) trail passive funds (those who buy and hold broad-based indexes) consistently over 10 years.

Look, whether it's an urban legend or a study done by a top business school, it's common knowledge that buying and holding quality assets and not touching them for the long term is a winning strategy for investing.

You don't need a PhD in economics to understand that. Unfortunately, too many crypto investors fail to grasp this simple investing principle. They buy on FOMO (fear of missing out) and sell on FUD (fear, uncertainty and doubt).

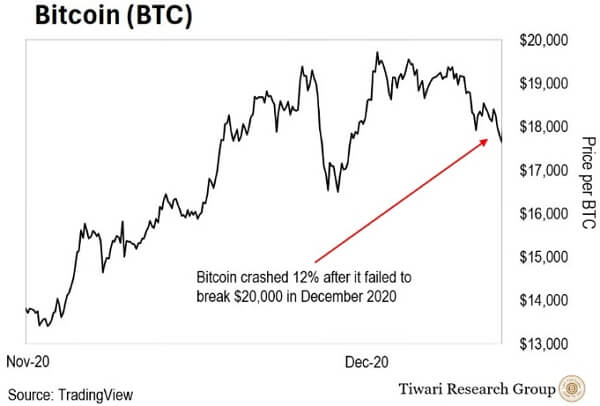

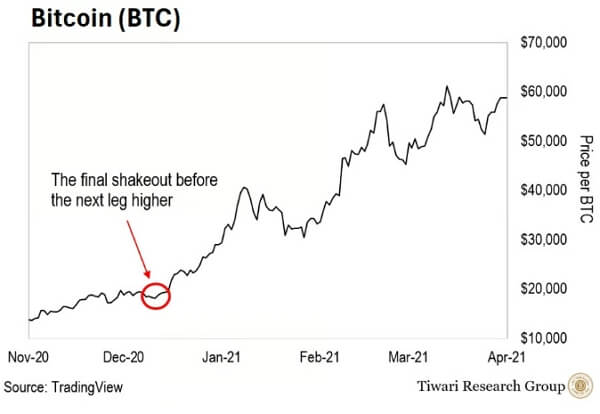

Here's why. December 11, 2024, marked the fourth anniversary of The Final Shakeout. Four years ago, on the same day, Bitcoin plunged 12% and trended lower after a failed break of its previous all-time high.

If you panic-sold, the decision probably haunts you to this day. But if you held on, you likely made life-changing gains. Since then, Bitcoin is up 470%. By comparison, the S&P 500 is up 66% over the same period.

This past week, we saw a similar shakeout. Bitcoin hit an all-time high above $103,000 on December 5 and fell as much as 10% by December 10. But if you're new to crypto, I don't want you to make the same mistake the weak hands made during The Final Shakeout of 2020.

$100,000 is just the beginning of one of the greatest bull markets in history. And if you stay on, you'll be rewarded just like those individuals who didn't let volatility shake them out four years ago.

Higher Highs Are Ahead

Ever since Daily editor Teeka Tiwari started pounding the table on Bitcoin in 2016, he's said you only need to get one thing right to make money from this asset over the long term.

Here is the thing: as long as the Bitcoin adoption rate increases, the price will follow. It's that simple. That simple story has proven true over and over again. Here's the thing: Bitcoin's upward trajectory remains intact.

Over the past year, you couldn't ask for a better adoption path than what Bitcoin is on right now. Since the first spot Bitcoin exchange-traded funds (ETFs) launched in January 2024, over $34.5 billion in assets have flowed into these funds.

In May, the Wisconsin Investment Board became the first state-run pension fund to invest in Bitcoin. This was a massive move, considering pension funds manage over $26.8 trillion in assets. If just 2% of these assets flow to Bitcoin, you'd see $536 billion in buying pressure.

The reelection of President Donald Trump in November was another massive catalyst for Bitcoin. President Trump has pledged to keep 100% of the Bitcoin the U.S. government holds or acquires in the future.

Today, the U.S. government holds 183,422 Bitcoins valued at roughly $18 billion. This Bitcoin was seized or confiscated for criminal activity. More importantly, President Trump has backed a strategic Bitcoin reserve for the United States. That means the U.S. Treasury would buy Bitcoin as a reserve asset – like it does with gold.

As was predicted, a victory for President Trump would kickstart a rally across the entire crypto market. And that has played out. Since November 5, Bitcoin has exploded as much as 53%. Again, by comparison, the broad stock market is up just 6% over the same period.

The importance of a major government like the U.S. buying Bitcoin cannot be overstated. It would force every other major country to add Bitcoin to their treasuries.

Earlier this month, Brazilian lawmakers proposed a bill to create a national Bitcoin reserve holding up to 5% of the country's international reserves. And just this week, Russian lawmakers proposed creating a Bitcoin strategic reserve. This came two weeks after Russian President Vladimir Putin signed a law recognizing crypto as property.

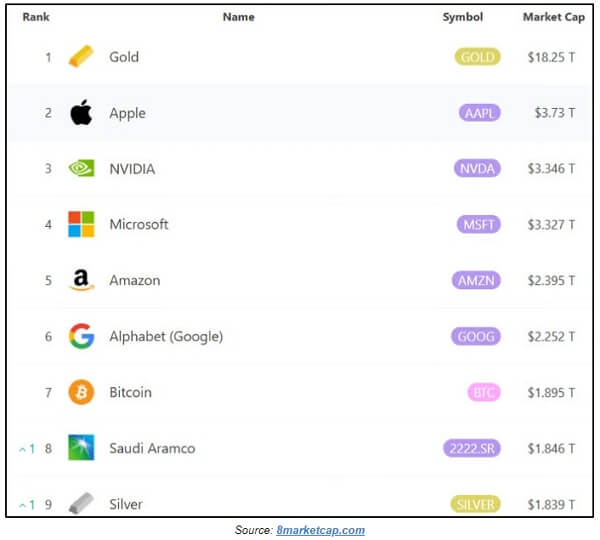

These moves by national governments to adopt Bitcoin as a strategic reserve will make Bitcoin a serious rival to gold. Right now, the value of the global gold market is $18.25 trillion, while Bitcoin has a valuation of $2 trillion. Bitcoin must go up nearly 10x from today's prices to reach gold's valuation. That means over $900,000 per Bitcoin.

But we live in a digital world where people spend most of their time online. And make most of their transactions via digital payment rails like credit and debit cards. So, it's only natural to migrate to a better digital version of gold.

You don't have to agree that Bitcoin is a better store of value than gold to make a small fortune from it. But let's consider this:

Over 20 years, the Silent Generation and Baby Boomers cohorts will pass $84 trillion in wealth to their children and grandchildren. Their grandchildren are Millennials and Generation Z, and they will buy Bitcoin.

Bitcoin Is a World-Class Asset

The chart below. It shows the valuations of the world's top assets.

It's easy to see when you consider where capital is allocated in the future. Bitcoin will climb the leaderboard. Again, the world is setting to half of gold's value, nearly 5x the current move.

Volatility is tough to stomach. And we saw plenty on the way in these days. If it weren't, everyone who bought Bitcoin in 2020 would be very prosperous today. So, if you find your faith wavering, remember the simple story: As long as adoption increases, the price will increase.

Some of the biggest buyers in the world are adopting this asset class – from pension funds to national governments. They won't care if you buy Bitcoin at $90,000 or $11,000 because they know it's going much higher. They plan to hold it for decades. And you should, too.

Remember, as long as you have sound risk management and areositioned in quality assets, the best thing you can do is nothing.

This article was printed from TradingSig.com