Weekly Market Review & Analysis For January 17, 2022

The stock market had a bad week, exacerbated by a tendency to sell into strength. In the end, the Dow Jones Industrial Average fell 4.6%. The S&P 500 index declined 5.7%, and the Nasdaq Composite dropped 7.6% and was in the territory of contraction, while small-cap Russell 2000 fell 8.1% and moved closer to the bear-market area.

The consumer discretionary sector market of the S&P 500 was the most vulnerable, suffering an -8.5% drop. It was closely followed by information technology with -6.9% and communication services with -7.1% declines. The utilities sector did outperform on a percent basis by registering an only -0.8% lowering.

The most critical selling triggers were likely concerns over profits margins, fear of investing in stocks with high growth, which provided dire reports, anxiety over the Fed's plans to tighten its monetary policy, and selling itself - which led to further selling.

Profit margin concerns were fuelled with Goldman Sachs amid the higher cost of compensation, Netflix amid the cost of programming increases, and PPG Industries amid the higher cost of raw materials. In fairness, several firms, including Procter & Gamble, demonstrated the power of pricing to offset the higher market price.

In a bid to pick on Netflix, The stock plummeted 22% following the discouraging Q1 guidance. This was similar to the drop of 24% on Peloton just a day before when CNBC claimed that the company had stopped the production of bikes because of the lower demand. However, Peloton contended that the report was not accurate.

Although Peloton was already sagging from all-time highs, as was Netflix in a lesser degree before the disappointing announcement, the stock took a massive loss with the signal to investors suggesting that other growth stocks may be facing similar challenges during the earnings period.

Interest rates were a significant issue for the market during the week since the yield of the U.S Treasury Two-year note brushed upwardly against 1.08%, and the Ten-year note yield skimmed close to 1.90%; however, an ebb at the end of the week offered no moral basis. This is likely since the move to U.S. Treasuries was caused by the worry about stocks falling.

In a week-over-week perspective, the yield for the U.S. Treasury Two-year note was raised by three basis points to 0.99%, while the U.S. Treasury Ten-year yield note decreased by two basis points to 1.75%. In the meantime, the U.S. Dollar Index advanced 0.5% to close at 95.63. The crude oil market jumped +1.29, or 1.5%, to finish at $84.76/bbl, which was pushed higher due to tensions in the geopolitical world arena.

Market elsewhere

Europe: European equity market(s) were down primarily with value, and cyclical stocks have higher weightings on this side of the pond. Markets were unsure about the final effect on the economy of a planned aggressive tightening of monetary policy to tackle continued inflation pressures. Industries and the materials sector saw notable declines, while the energy sector cut back on the recent rise when crude oil prices took out of the fire.

Additionally, the consequences of higher interest rates due to the tightening in monetary policy affected growth-related industries, including consumer discretionary and information technology problems, which were among the most significant decreasers in the region.

Asia-Pacific: Stocks market in the Asia-Pacific region generally finished the trading week with substantial declines, with markets being tense over the possibility that certain large central banks around the world, led by the Federal Reserve in the U.S., may be called to tighten their monetary policies to curb rising inflation.

As elsewhere, the technology sector continued to suffer because of the potential for increasing interest rates. Economic growth also affected the cyclical stock markets in the region, just like in America and Europe, notably energy and materials.

The Eurodollar initially dropped during the week's trading session though it has seen such rough moves on Thursday and Friday with obsoletion our Mean Sup 1.1325. Quite frankly, this is an oversold market, so this shouldn't be a big jaw-dropper.

When you examine this chart, you notice that the currency is on its way to revisit completed Inner Currency Dip 1.1200. This suggests that the Euro will get more volatile and, therefore, may run towards the Mean Res 1.1400 handle and possibly the Mean Res 1.1455 mark.

Metals market

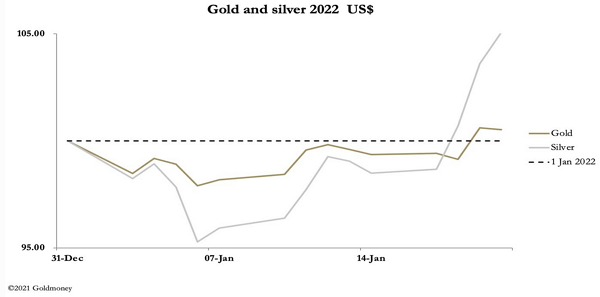

After the first week of 2022, the silver price has rallied very powerfully in the metal market, up by nearly 10%. This week gold climbed $18 from prior Friday's closure to finish at $1835, and silver by $1.34 to close at $24.27 at the same time frame. The majority of the rise was on Wednesday's session, with Friday seeing somewhat price consolidation.

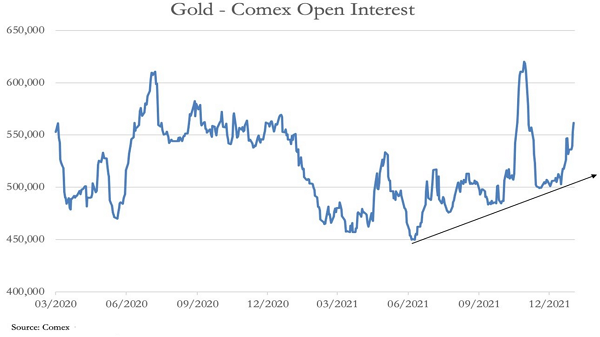

Gold's Open Interest (OI) on the Comex exchange is climbing strongly, and the initial number stands at 561,759 contracts. This is shown in the following chart.

This article was printed from TradingSig.com