Weekly Market Review & Analysis For April 25, 2022

The market had a tough week, which brought a close to a much even worse month for the equities. The S&P 500 dropped 3.3 percent for the week, which is slightly better than the -3.9 percent loss for the Nasdaq Composite, small-cap Russell 2000 by -4.0 percent, and the Dow Jones Index, which dropped 2.5 percent.

Aside from brief spurts of short-covering market activity, earnings relief bids, and Plunge Protection Team (PPT) oriented buying; the market stayed pressured by unease about the Fed aggressively tightening interest rates policy in a low growth environment, a high inflation period.

The report of the Advance GDP showed the signs of stagflation; however, fake unemployment data remains historically low. Real Gross Domestic Product (GDP) dropped by 1.4 percent in the initial quarter of this year, and it was the GDP Chain Deflator that rose by more than expected 8.0 percent.

The following instances further demonstrated the pressure on the market:

- Apple warned of increased costs related to supply chain issues in the fiscal quarter ending March 31; Amazon.com guided Q2 revenue and operating profits fall short of expectations.

- The PCE Price Index swelled 0.9 percent from month-over-month, bringing the year-over-year rate to 6.6 percent from 6.3 percent in February of this year.

- The first quarter Employment Cost Index jumped to 1.4 percent.

- The West Texas Intermediate (WTI) crude oil futures rose over $105.00 per barrel to close at $105.03, increasing +3.03, or +3.0 percent.

The market risk sentiment was further impacted due to the mixed state of earnings data when looking at their results and guidance and the reactions. Meta Platform came to the fore in the mega-cap earnings. Its earnings jumped by 9% on better than anticipated results; however other stocks, such as Teladoc, continue to be crushed by disappointing announcements.

U.S Treasury yields were slightly lower at the end of the week due to increased demand. The yield on the Two-year note decreased by three basis points to conclude at 2.69 percent, while the Ten-year yield fell by two basis points to close to 2.89 percent. In the meantime, the U.S. Dollar Index rallied by 1.9 percent to close the week at 103.20.

Additionally, the Twitter board agreed to be purchased by Elon Musk for approximately $44 billion, for the original offer of $54.20 per share in cash. Musk disposed of over $8 billion worth of Tesla stock to fund the deal.

Market elsewhere

The Asia-Pacific region market mainly ended to the upside as the Technology sector promoted the Chinese and Hong Kong stock markets. The Eurozone gained ground on concrete key economic sector earnings reports and mixed economic numbers.

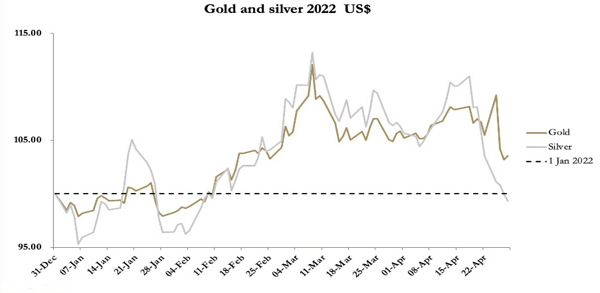

As the chart below shows, the gold and silver market had a scorching trading week, especially for silver, which is now slightly down on the year thus far. Gold was at $1,895, down $35 for the week after declines the prior week. Silver traded at $22.74, down $1.36, expanding current falls and pushing the gold and silver ratio to 81.4.

Bitcoin is getting into a very narrow playing range and is inclined to a significant impulse move after completing our Inner Coin Dip of $37,000.

Market forecaster roulette

If you’re active in the market and new to this TradeSelecter.com website, our passion for looking at tea leaves and charts might seem dubious. Notwithstanding, it comes down to simple reasoning: If we can out-think and out-forecast the markets by a good margin - which we often do, it is the reason we are out-trading the market.

This article was printed from TradingSig.com