Trading Week Ended December 22, 2017

Rock solid trading sessions all round in all time zones, with the concluding week before Christmas holiday weekend. A lot chat concentrated again on the American tax reform which is considered as negative for the United States Dollar. Dealing with many Forex trading desks the impression is this step refocuses attention domestically, and quite a few raise questions even though it will do the job!

Many people overlook any a positive outlook which small businesses to create jobs and are counting much more on the multinationals. The true competitiveness by which the United States could very well build for itself can offer significantly to investors and traders worldwide. A good reason is that the equity markets are rallying on investment capital flow as well as the rejuvenating fresh look at offering business opportunities.

Cryptocurrency Market

In the cryptos market, a lot of talks were all around Bitcoin and its price drop. During this week, we come across a decline of almost 50% from its highs. Not much of a surprise that limits down has been hit, which in turn triggered a suspension of trading on the CME futures contract. The reasons why this push have been about speculation and the last rumor heard that of the volatility pay-out would need to be deferred for five trading days pertaining to security reasons. This, in turn, upset the marketplace all the more and merely increased the long liquidation.

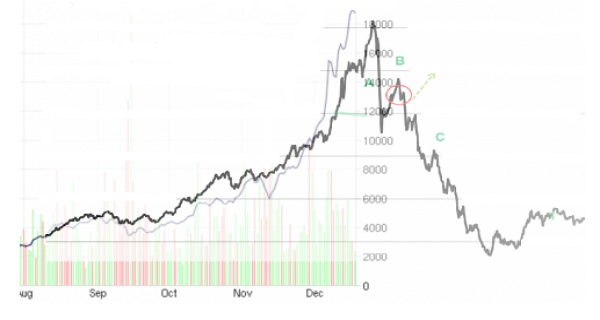

This past week Bitcoin currency accelerated past the $19,000 to lightly pressing $20,000 mark. As you will notice on this chart below, the velocity of increase has just marginally past the peak of the US stock market bubble during 1929 crash once you simply align the curves.

Just what exactly should be or worry with regards to is the fact that bubble top might be in and understanding that would come to the substantial removal of “the wealth effect.” That is because Bitcoin has an enormous notional value. Precisely about $320 Billion worth!

To be assured, the data numbers argue (for now that is) that Bitcoin cryptocurrency will not drop all the way to nil. Preferably, it needs to level-off within the $500 range, and that would be your most likely stage that the globalists would likely step in with very most of the job of the unbacked, a universal currency will be carried out on their behalf.

This can be a very, long-term task. The majority of individuals do not possess the intelligence to game the best route to the workplace the majority of mornings, much less thinking in decades-long strategic terms and conditions. In the meantime - the Santa Clause Rally goes on.

Crypto-Dollar trading anyone? So how does anybody think that the modern world could work having a payment processor which has 1,360 plus cryptocurrencies which are continuing to grow and maintain dramatically with a brand new ICO (Initial Coin Offering) just about every day? Cryptocurrency in their current form will not be approved as legal tender.

Bitcoin cryptocurrency has risen over 20 times in 2017. If that had been a current currency, it would show a 1,900% plus inflation or even more specifically hyperinflation. However, Bitcoin isn't money. Furthermore, it may never be utilized as a payment system as a result of slow speed regarding financial transactions. Bitcoin cryptocurrency along with other cryptos are merely a digital kind of tulip bulbs.

Therefore if there will be a fresh new currency in 2018, it's less likely to be Bitcoin or even any one of the 1,360 plus cryptos. It's possible that Bitcoin crypto was created by authorities to test out how cryptocurrencies will be acceptable to the public. Or perhaps it may be as Catherine Austin-Fitts (as a former Assistant Secretary of Housing) thinks that government authorities are carefully observing the crypto mania and also allowing private organization develop the marketplace before they will step in and ban all of the cryptos and deploy their own.

US Trading Market

In trading markets, the fact was that the S&P500 was merely up 0.3% for the week. However, it was an excellent week for the stock market along with the Republican party. Both have been interwoven with the party-line successfully passing the tax bill, which proclaimed the most important revamp of the tax code since 1986 era.

The core benchmark DJIA, the S&P500 Index, the Nasdaq Composite, with the Russell2000 Small-cap, and the S&P Mid-cap 400 Index all wrapped up the week higher, with results which ranged from 0.3% to 0.9% across the board.

The Wall Street talk was continuing to concentrate on Bitcoin and Friday’s price drop, and the US Senate approved tax Bill, as well as government avoidance a near-term shutdown: at least right until 19th of January. Friday’s economic numbers were sluggish than estimated and in all probability precisely why the market could not finish on the positive note. This year has become an excellent year for all essential indices along with reassuring set-ups for the upcoming New Year.

European Market

Eurozone key stock markets traded heavy following the separatist triumph within the Catalan regional vote. The Spanish IBEX35 finished down 1.2% on Friday, in which actually was a result following the open by being down 1.55%. Spain’s big bank securities virtually all shed over 2% on the trading day. The German DAX30, UK's FTSE100 and French CAC40, all closed down about minus 0.25%. In fact, this was an excellent result for the FTSE100 following terrible consumer spending data.

One unusually hot topic in Eurozone encompasses the European Central Bank and a German Parliamentarian which are being sued by the former Greek Finance Minister-Janis Varoufakis for the disclosure of the legal opinion brought about in 2015. The consequence of which caused limited funding to Greek financial institutions but may have over rich its level limiting liquidity. I shall address the specifics in greater detail soon.

Asia-Pacific Market

The majority of leading Asian-Pacific indices ended on a positive note having KOPSI Composite Index recuperating most of Thursday's losses but helped by the milder overstated claims of NK language. The HK's Hang Seng traded well after better technology sector performance. However, these increases may likely be reversed after Bitcoin price activity witnessed later on Friday trading day. Volumes have been once again of former-self. Therefore, it is tough to get too pumped up about the Asian-Pacific trading.

Metals And Commodity Market

West Texas Intermediate crude oil dropped $0.18 to $58.30 per barrel, along with wholesale petrol which gained $0.01 to $1.77 per US gallon. In other markets, the Gold spot price settled $7.6 higher to $1,274 per ounce, and also the US Dollar Index (DXY) a comparison of the six major global currencies to the US Dollar was higher 0.1% closing at 93.93.

When the Federal Reserve lifted interest rates on December 13, a large number of traders and investors assumed that Gold would tumble. However, it did not happen. Gold metal bottomed the next day following the interest rate hike and then started out heading higher once again.

By the way, a similar thing took place following the Federal Reserve tightened rates in December 2015. Gold had undoubtedly one of its very best quarters throughout two decades in the first quarter of 2016. As a result, it has been exciting to see Gold rising in spite of headwinds from the Federal Reserve.

That tells me that there’s something more to the story and that there is something more taking place under the surface which has been driving the Gold price much higher.

The brand new Eastern crude oil benchmark is going to be launched shortly and might quickly become much more vital than West Texas Intermediate or Brent Crude. That is just because the East’s economic climate is both bigger as well as faster expanding as opposed to West’s. Furthermore, crude oil is a more critical element of the East’s Gross Domestic Product than the West’s. Therefore it is natural for trading in Yuan currency to be expanded from crude oil with other commodities and ultimately to all trade-in the East.

What's Ahead for Next Week Trading

Next week trading market action will probably continue to be somewhat subdued in the next week. Data on pending home sales, Chicago business activity, and consumer confidence can still draw interest in the closing trading week of this year.

The overseas economic front schedule next week will also be thin having data on Japan's industrial production, consumer price inflation, household spending, and retail sales. China will publish-industrial profits. In Europe, Germany reports on consumer price inflation.

Related Pages

Trading signal service for you!

Live Signal

Trading Market Overview, 2017