Is Tether cryptocurrency Falls Next?

Authored by: Jeff Brown

With all of the chaos caused in the world of cryptocurrencies from the outright fraud perpetrated by Sam Bankman-Fried (also known as SBF) and his team – which resulted in the implosion of cryptocurrency exchange FTX – it’s natural for us to wonder: What’s next - Tether?

Many venture capital (VC) funds invested in FTX – like Sequoia, SoftBank’s Vision Fund, and others – have already written down their investments to zero.

We now know that SBF stole at least $10 billion of client funds, moved it to his personal crypto hedge fund Alameda Research, and then “lost” the money. As a result, Alameda Research has imploded as well.

The reality is we don’t yet know all of the counterparties. But the situation is already far worse than what was believed last week. And the more we learn, the worse it gets.

We’ll certainly keep a close eye on these events in the coming days. But today, I can’t help but wonder who or what will fall next. And I can’t help but wonder about Tether (USDT), the largest U.S. dollar stablecoin in the industry.

Not only is Tether the largest U.S. dollar stablecoin, but it’s also now the third largest cryptocurrency in the world by market cap. That makes it critically important to the industry.

Stablecoins, by definition, are supposed to be stable. They accomplish this “peg” to their underlying currency by backing each stablecoin 1:1 with a U.S. dollar-denominated asset.

Put simply; there should be one U.S. dollar in reserve for every one U.S. dollar stablecoin.

In reality, stablecoin projects can hold U.S. dollars in cash accounts and other U.S. dollar-denominated instruments like U.S. Treasuries or U.S. dollar money market funds.

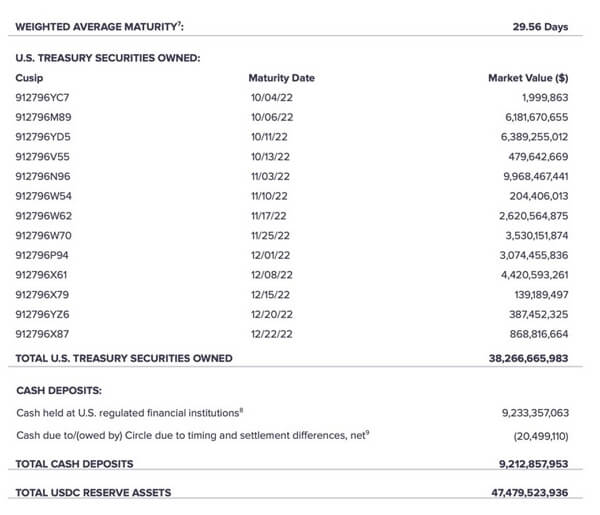

As an example, here’s the balance sheet of Tether competitor Circle and its U.S. dollar stablecoin, the USDC:

Circle keeps it simple. It holds a range of short-duration U.S. Treasurys that make up the bulk of its reserves, and about 20% of its reserves are in cash.

At the time of the audit on September 30 of this year, Circle had issued 47,261,819,834 USDC. Therefore, it had slightly more in reserves than stablecoins issued at the time—completely safe, backed by U.S. dollar assets, with no risk of failure.

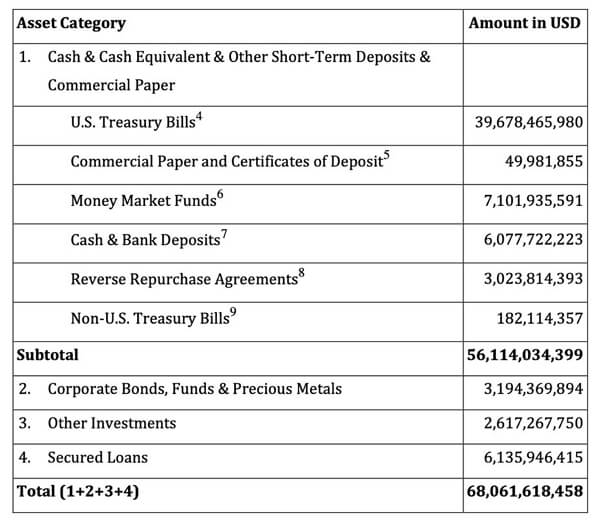

Now, let’s have a look at Tether’s September 30 audit:

In the first category of “Cash & Cash Equivalent,” we can see that about 82% of Tether’s reserves are in U.S. dollar-denominated safe instruments. Except for the $182 million in “non-U.S. Treasury Bills,” the rest in this category appears to be fine.

But what about the other 18% of Tether’s holdings? Is it a 1:1 reserve holding of U.S. dollars to back up the Tether (USDT) issuance? Not even close:

- $3.2 billion are in corporate bonds, funds, and precious metals.

- $2.6 billion are in “other investments.”

- $6.14 billion are in secured loans.

For a company that prides itself on “transparency,” there’s no additional information about what those investments look like.

And on page two of the independent auditor’s report produced by Italian firm BDO, there’s a particular bullet point from the auditor listed in “Emphasis of Matter”:

The valuation of assets of the Group has been based on normal trading conditions. It does not reflect unexpected and extraordinary market conditions or the case of critical custodians or counterparties experiencing substantial illiquidity, which may result in delayed realizable values. No provision for expected credit losses was identified by management at the reporting date.

As analysts and investors, we should ask ourselves: “Are these normal trading conditions we’re experiencing right now?”

The answer should be obvious - Absolutely not.

The reality is that about 18% of Tether’s reserves are invested in assets that can experience volatility in price. And since Tether only conducts an independent audit once per quarter, no one has any idea what the value of that 18% of reserves looks like. And we won’t wait until sometime in January.

Tether also doesn’t have any financial provisions for credit losses. In other words, if the value of that 18% of reserves declines, it’s not backed up by anything. The team at Tether assumes that everything will be just fine, irrespective of what’s happening in the markets.

Tether’s “transparency” – or lack thereof – stands in stark contrast to Circle, whose independent auditor, Grant Thornton, provides a monthly attestation report.

I don’t trust Tether. A lot can happen in three months. And in the event of another significant market downturn in the coming months – which I believe we’re in for – the value of the combined $12 billion in non-cash assets could quickly drop by several billion.

And when that happens, the Tether stablecoin is no longer backed 1:1.

That is the exact kind of situation that leads to a bank run. The same thing happened with Terra Luna, and we just witnessed the collapse of FTX and Alameda.

Stablecoins are a fantastic financial instrument if well-managed and backed 1:1. They allow investors to move out of digital assets quickly and cheaply and into a digital version of a fiat currency as a store of value. This saves the time and expense of the off-ramp to an actual fiat currency.

My recommendation is this: Stick with stablecoins that are backed 1:1 with reserves in cash and short-duration bonds. Tether is a disaster waiting to happen.

This article was printed from TradingSig.com