Stock Market Trading Commentary & Analysis October 6, 2019

Week in summary: Economic data leaves stock market trading mixed in a very active and volatile start to the final quarter of the year.

The S&P 500 index posted -3% in a volatile week of stock market trading. Various market news announcements reawakened economic growth concerns and provided energy to heavy selling; however, the stock market was able to conclude the trading week on a positive mark following fair employment numbers for September. The DJI Average dropped 0.9%, while the small-cap Russell 2000 index lost hefty 1.3%. The Nasdaq Composite rose by 0.5 %.

Five out of eleven S&P 500 index sectors ended lower, while six sectors ended higher. The vital energy sector posted -3.8%, materials sector ended -2.5%, industrials sector finished -2.4%, while financials concluded with -2.2% print. These were heavy losses, as did the Dow Transportation Average posting -3.0% loss. A couple of sector winners were information technology with +1.1% and health care finishing with +0.9% showing relevant strength. The PHLX Semiconductor Sector Index (SOX) rose 2.0%.

The ongoing instability in the manufacturing sector pushed traders and investors to reassess their earnings forecasts and premium market valuations, especially if the instability-weakness fools the consumer-oriented services stock market trading sector. As speculated, and evidenced by the numbers, non-manufacturing action did slow down extensively, though the ensuing selling action may have been very too soon, and too much.

There was one moment when the S&P 500 index was down, whopping 4.1% in less than three trading sessions. An opportunistic frame of mind took a turn, most likely supplementing to unusual short-covering trading activity, to help the broader index to bounce from a brief oversold market condition. The BTD (Buy The Dip) energy picked up right after the employment data revealed modest job growth, moving the S&P 500 back into 'Possible Additional Pullback Zone' by week's end.

Stock market trading and other news stories

Another remarkable and noteworthy stock market trading story involved Charles Schwab brokerage, which eliminated trading commissions for all stocks, ETFs, and options listed on the United States or Canadian exchanges. E*Trade and TD Ameritrade brokerages immediately followed suit - The shares of all three brokerage firms posted significant losses last week.

United States Treasury yields extended its decline amid the increasing concerns and mounting expectations for the Federal Reserve to cut interest rates not only this month but also in December. The Two-year yield declined 23 bps to 1.39%, and the ten-year yield dropped 16 bps to 1.52%. The U.S. Dollar Index faded by 0.3% to close at 98.74 for the weekend. The West Texas Intermediate (WTI) crude oil dropped 5.6% to $53.05, further pressed by building inventory levels.

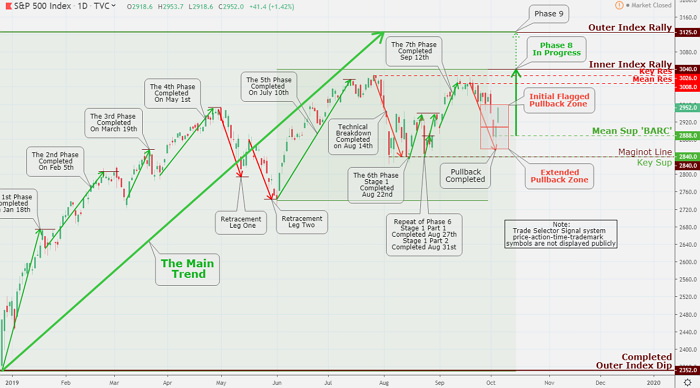

Chart of the week

Click the Image to Enlarge

S&P 500 market bearish sentiment has been going off their October 1 oversold conditions; however, more bullish circumstances are revealed with the current market trend rebound of Extended Pullback Zone with very symmetrical BARC conformation and re-initiation of the Phase 8 movement. The index downside pathway of most limited support lies with Mean Sup $2888.