Silver metal surges when inflation is climbing

Silver is set to erupt due to the tailwinds of the New Energy mega-trends. Metal is an essential ingredient in electric car batteries and solar panels. Both will play a greater part in the shift to New Energy. The main point is that silver's role as a green energy player creates a positive picture for the metal's future.

Silver as a precious metal offers wealth preservation

Silver, like gold, is also precious metal. Many own and purchase the metal because of the same reasons that they buy gold: to safeguard their wealth from the adverse effects of actual interest rates, inflation, a soaring government debt, and unprecedented money printing.

Interest rates are currently negative (when adjusted to account for inflation), which means individuals lose money for every dollar they earn. The U.S. Government's debt has risen from $23 trillion at the beginning of 2020 to over $28 trillion, funded mainly through money printing by Fed's money creation from thin air.

Based on the Federal Reserve, M2 - a stockpile measurement of U.S. Dollars - rose from $15.41 trillion in January 2020 to $21.43 trillion as of November 20, 2021. This implies that more than 28 percent of U.S. Dollars in existence were issued in the past 22 months.

Although money printing is not new, the growth of money supply used to fight the adverse effects of the COVID-19 epidemic and pay for the federal government's generosity is unprecedented.

And it is also bullish for gold

Remember that gold and silver are the most effective type of wealth insurance. They have preserved wealth in many crises in the past.

An ounce of silver will get you the equivalent amount of bread as it did during Roman times. And, if you want a recent paradigm, 20 ounces of yellow metal can still get you a good-looking car, just as it did about a century back.

The phenomenon of money printing has resulted in an abundance of newly printed money and continues to be absorbed into the world economy. When it coneys, it will initiate the case of a bubble in gold and silver as investors look for reliable options to safeguard their wealth from the effects of inflation.

It has not yet happened, though it will, as our history demonstrates that. U.S. inflation has skyrocketed from 1.4 percent in January 2021 and is now 6.8 percent at the moment. There is no indication of a slowdown anytime soon.

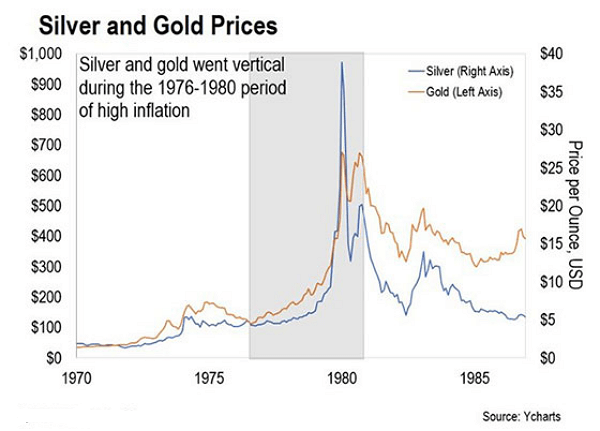

Take a look at the chart below. It illustrates prices for silver (blue line) along with the gold (orange line) prices in the period of high inflation from 1976 to 1980 (shaded area).

In 1976 the inflation was hovering around 5.8 percent. By 1980, it has risen to a monumental 13.5 percent. You can also see how the gold and silver markets performed. Gold gained a whopping 415 percent, while white metal gained more than twice that amount - to stunning 857 percent.

The reason why silver is going to outperform gold once again

There are two unmistakable reasons why white metal outperformed gold during the time of high inflation, and the reason we believe that it will continue to do so during this period.

Around 80 percent of white metal is extracted as a byproduct of industrial metal mining. Therefore, silver's supply does not react at the same speed - when it comes to rising prices as the gold supply responds typically.

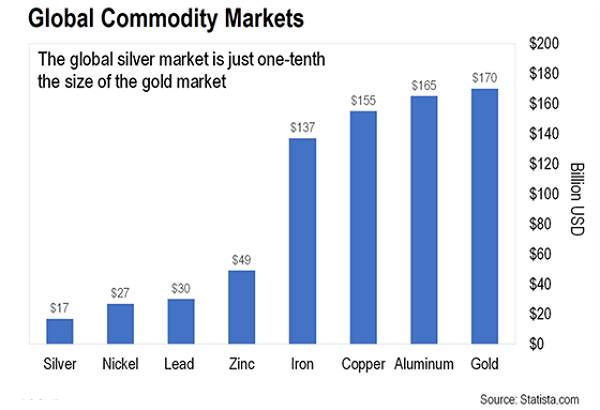

The result is that supply shortages could result in much higher white metal prices, and there is also the size of the white metal market. The chart beneath illustrates how small the silver is comparable to other commodities.

It is evident that the white metal market is smaller than the demand for zinc and nickel. The market is only one-tenth the market size of gold.

An undersized market takes only a tiny amount of money to drive prices up in such a small market. Large quantities of money could dramatically affect the price in a short time. This makes gold's unstable cousin more prone to more explosive upside bursts because money is typically pumped into it during times of high inflation.

The separation between potential and price movement

The best part is that silver currently remains at an affordable price. It fell by around 11 percent this year. It's a pretty poor performance compared with the booming of other commodities markets.

For example, the S&P Goldman Sachs Commodity Index (GSCI) consists of 24 commodities across all commodities sectors, increasing by 42 percent over the past year. Cotton is up by 45 percent; Copper has risen 26 percent; sugar has increased 21 percent. Oil has performed even better, with an appreciation of 57 percent in the first half of this year.

Thus, silver is relatively inexpensive at the moment. The metal is trading at a price that is well lower than its July 2020 value that was around $27 before when the printing presses of the Federal Reserve indeed went into overdrive.

In plain English, it is trading as though there was no printing of money taking place. That is another illustration of a gap between the market for financial instruments and the actual economy. If you know how to exploit it can assist you in finding the best opportunity to build wealth in your life.

Profiting from the market disconnect

How can you make the most of this opportunity? One of the major drawbacks when investing in gold and silver coins is that white metal coins and bars can be heavy to keep in storage.

If you are new and unfamiliar with investing in white metal, a different method to gain exposure towards the precious metal can be by investing in exchange-traded funds (ETF). An ETF is a fund that invests primarily in metals that are hard assets and can be purchased via a brokerage account.

Our choice is Aberdeen Standard Physical Silver Shares ETF (SIVR). The fund houses its meatal in London, England, but it is listed on the NYSE (New York Stock Exchange).

The next few years are likely to be a massive uptrend for white metal. Thus this is the perfect time to add an unbeloved metal to your investment portfolio.

Related articles

Trading and Investing The Markets For Your Real Wealth

With silver protect and grow your wealth