Purchasing insurance coverage and letting them pay you

The insurance business model is to collect more premiums than to pay out in claims. The difference between those two numbers is their raw profit.

There are countless advertisements on television that promote health or other types of insurance. They always talk about the low cost of premiums, but they don't discuss the deductible part.

If you do not have health insurance from your employer, this deductible could be an enormous financial burden. It's a way to be responsible for health policy premium payment: but, you can not afford to use it.

There are years when you pay your policy premium but don't file any claims. For example, in 2019, only five percent of insured homes had filed a claim.

That means all the premiums paid for coverage policies - for those who can not afford to file a claim and those who do not need to - will go directly to the insurance company's bottom line.

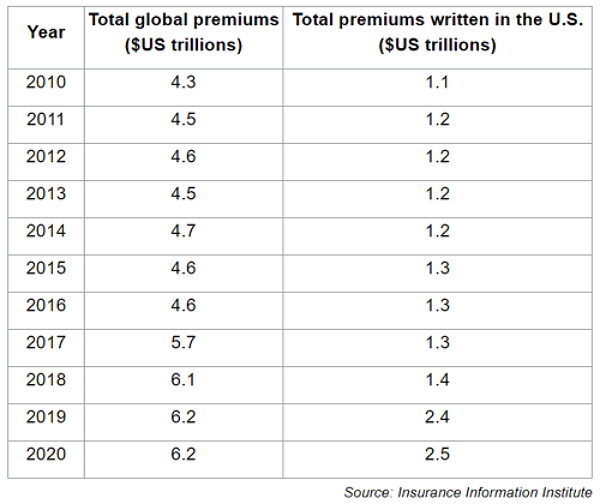

Globally, the insurance companies composed $6.3 trillion in policy premiums last year. Of these premiums, $2.5 trillion was written in the U.S. alone.

This makes the U.S. the most prominent insurance market worldwide, with around 40 percent of the world's marketplace for protective umbrella business.

Today, the U.S. market has more than doubled in the past ten years. The constant growth is shown in the table below.

In conformity with Insurance Business America, global premiums are expected to rise to $10 trillion by the end of this decade. This means that the U.S. market could be worth upwards of $4 trillion by the end of 2030. This is 60% more than the current value.

Let the insurance companies pay you

Insurance may be an undesirable business; however, it is all about reducing the number of exposure risks. This is why it has grown by a massive amount in the past decade and is expected to continue to expand in the near future.

This internal conflict that we experience every day drives us to the root of the disconnection between the market for financial instruments and the real economy.

We're aware that risks exist. We do not want to believe that it could impact us, yet we pay to be safe. We pay for it even if it involves sacrificing our lives' aspects to make us happy.

Suppose it's health, life, and auto insurance, whether or home-related risks, each of these areas represents a growing market for the industry. The majority of people want to safeguard their family members, themselves, and their companies from threats surrounding them.

How can you benefit from this gravy train?

One of the easiest methods is to invest in an exchange-traded fund (ETF). An ETF lets you own some of the top brands in the industry with just a click of your mouse.

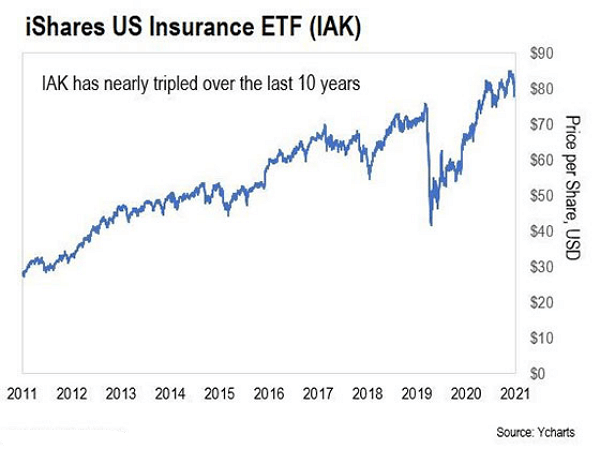

My most favored insurer is iShares U.S. Insurance ETF (IAK). It follows a range of the most prominent brands within the U.S. business, including Prudential, Progressive, and Allstate. Take a good look at the chart below:

As you can observe, the fund has been increasing more or less by 200% over the past ten years. Furthermore, the U.S. protective umbrella industry is estimated to increase by $2.5 trillion to around $4 trillion by the end of this decade; I anticipate IAK to continue its upward trend.

This is what makes an iShares U.S. Insurance ETF (IAK) an excellent investment now if you're looking to help the insurance industry to work to your advantage.

In addition, it offers dividends of 2.3 percentage. This is higher than the yield for the S&P 500 index, which was 1.2 percent at the date of writing.

This article was printed from TradingSig.com