Moving Averages And To Be Unmoved By Them

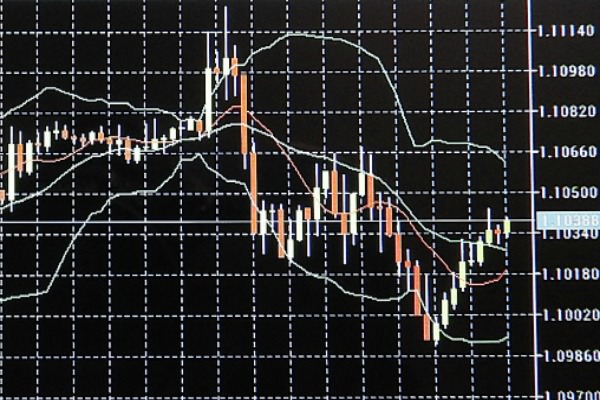

When moving averages (MA) start to rise or fall precipitously should you sit up and pay extra attention? The short answer is: No, you shouldn't.

Let me unpack that answer and show you some of the justifications for it. They really boil down to keeping a firm grip on your own human psychology and resisting the temptation to be irrationally swayed by a moving averages.

Take the moving averages with a grain of salt

Moving averages do help sometimes, and they are handy figures to have around. However, take the MA with a grain of salt. There's an inherent danger in assigning a number more weight just because it's been arbitrarily attached to a nice round number. MA's taken with a fixed numbers such as 5, 21, 50, 100 and 200 days are particularly popular, but there's no reason for them to be. At www.tradeselecter.com, we prefer to derive our signal figures from price action data instead of arbitrarily-selected moving averages.

It is a not appropriate and I don’t want to go here through reviling a proprietary trading methodology. However, if you’d like to replicate a tiny corner of my work, one simple exercise is getting thee over to Trading Results page. Whatever source of historical data you might have excess for any currency, index of your choice and then look at the charts and see which one of your test cases does shows you the optimum signal.

Instead of following someone's lead and taking instructions about how to do analysis, look at the raw numbers yourself and let your intuition guide you to insight. Today traders are practically drowning in ready-made "one size fits all" solutions and strategies. TradingSig.com has seen all too many traders succumb to the temptation of following a party line instead of thinking for themselves.

We prefer to see traders exercise their independent minds. We love the individuals who take the extra moment to look at examples and models and ask the important questions, like "why did TradingSig pick that particular price for entry and exit?"

Off the shelf, solutions are problematic because they're designed for use without thought. Are you a thinking human being or a lever-pulling automaton? There's no point to hoping for trading success by giving up logical thought and analysis. If you go down that road, you're going to get beaten sooner or later - it will either be a thinking trader who has the insight and thoughtfulness to invent a new approach or by a methodology that can simply pull the levers faster than you.

We work with traders who are actively engaged with their numbers, people who know (or want to learn) how to do their own derivations. Indicators are only truly useful when you intimately understand how they work. Before entrusting your hard-earned money to things like moving averages, break them down and build them back up using your own numbers. Even after you understand how MA work, paper trade with them for a bit to confirm that you're on to a winning strategy. If you assemble a system that regularly outperforms off-the-shelf systems, you know you've got a winner.

In a nutshell

Of course, this ultimately means building a unique system that works for you and only you. There's nothing wrong with that - especially if it delivers better results than those off-the-shelf products. How can you tell if you're trading intelligently? Well, if you're socking money into the bank on a regular basis and worrying about your capital gains taxes, you're probably doing something right.

Related articles

Trading signal service for you!

News Blog