Weekly Market Review & Analysis For October 5, 2020

The technology market sector delivered nice gains this week, though not as well as various small-cap/cyclical/value equities, as traders and investors felt more substantial confidence in a recovery. The small-cap Russell 2000 rallied 6.4%, easily outpacing the broad S&P 500 index, which posted a respectable +3.8%, heavy-loaded Nasdaq Composite with +4.6%, and DJI Average print +3.3%.

Highlighting this week's most important stories: President Trump quite easily recovered from the COVID, eliminating some political dilemmas. The White House was reportedly sketching a $1.8T stimulus measure, supporting relief expectations. Regeneron and Eli Lilly asked for emergency use authorization for their coronavirus antibody medical treatments, conceivably aiding consumer sentiment mood.

The stock market climbed four of the five sessions, and every sector in the S&P 500 index ended the volatile week in the black zone. The materials sector with +5.1%, the energy sector with +5.0%, information technology sector +4.6%, and utilities sector with +4.6% all advanced above 4.0% unsettled real estate sector traded lower with a 1.4% gain.

The semiconductor sector was supported by Taiwan Semiconductor Manufacturing Company reporting robust revenue increase in September, NXP Semiconductors N.V. (NASDAQ: NXPI) raising third-quarter revenue guidance beyond consensus and report that Xilinx Inc. (NASDAQ: XLNX) is in discussions to be taken over by AMD (NASDAQ: AMD) for $30 billion. The PHLX Semiconductor Sector Index was mounted by 8.0%.

The only session the market finished lower was when President Trump said he canceled stimulus discussions until after the election. However, the President later explained that he still supposed the stimulus bill but as the standalone for small businesses, households, and airlines. This was eventually superseded by the $1.8T news reports after the week.

Market action elsewhere

U.S. Treasuries market faded amid the risk-on mindset amongst investors and traders, driving yields higher in an interest curve-steepening trade. The Two-year yield rose three basis points to close at 0.16%, and the Ten-year yield rose eight basis points to finish at 0.78%. The U.S. Dollar Index dropped 0.9% to close at 93.06. The West Texas Intermediate (WTI) crude oil futures climbed $3.59 or 9.9% to close $40.64/bbl.

All significant Asian and European stock market was higher. But, United Kingdom stocks loitered other large Eurozone markets as remarks from both European Union and UK politicians presented a no-deal Brexit at the end of this year seem more likely. In China, including the Shanghai Stock Exchange, equity markets were closed for trading on Monday through Thursday due to the Golden Week holidays.

Cryptocurrencies

The big news this week: publicly-traded company Square, Inc. (SQ) acquired 50 million dollars worth of Bitcoin to add to its company treasury. The Bitcoin market reacted immediately, jumping up 3% in a matter of hours on Thursday.

Square’s Bitcoin acquisition propelled the price to a weekly high by busting the $11,000 critical resistance level. Right now, more than half a million Bitcoin have been bought by companies. This makes the Bitcoin market even scarcer, which could be beneficial for the price overall. Which companies will follow? Stay tuned!

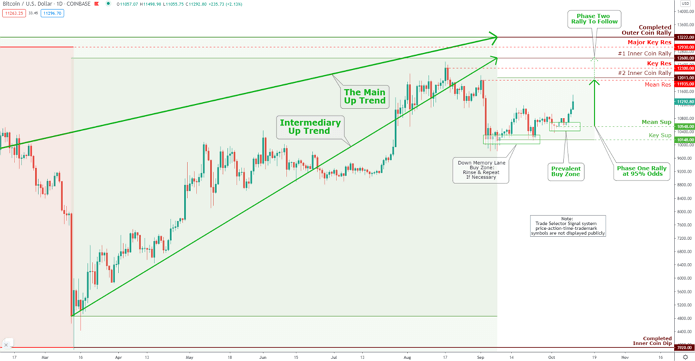

Click the Image to Enlarge

Technical Analysis and Outlook: Bitcoin's price broke out of a powerful resistance of $11,000. As a result, the price is advancing to Mean Res $11,935 and #2 Inner Coin Rally marked at $12,013 - The trifling retest is expected, buy the ''Rinse and Repeat and ''Prevalent'' zones. Phase Two of the rally is very much to follow. To continue the rest story, see 'Weekly Market Review & Analysis For October 5, 2020, page.