Weekly Market Review & Analysis For November 15, 2021

After the market's prolonged winning streak this week, stocks have returned to winning mode in which by "market," we mean the mega-cap stocks. Its Vanguard Mega Cap Growth ETF (MGK) gained 2.2%, as the Invesco S&P 500 Equal Weight ETF (RSP) dropped 1.2%.

The S&P 500 with +0.3% and the Nasdaq Composite with +1.2% have set records for closing highs this week by having greater exposure to growth in mega-caps. In contrast, the Dow Jones Industrial Average with -1.4% and small-cap Russell 2000 posting -2.9%, which are more exposed to cyclical names, finished the week with 1% and 3% losses, respectively.

The market overall was slowing down due to lingering fears about growth following Walmart (WMT), as well as Target (TGT), which stated they would absorb inflation pressures to maintain prices; Cisco (CSCO) released revenue warning due to the continuing supply issues.

Next, U.S. Treasuries pushed higher in an exchange of safety-to-flight as crude oil prices dropped 6% amid fears of less demand and possibly a rise in supply should countries tap into the oil reserve. The yield on the Ten-year note fell by four basis points (bps) to 1.54%. Its U.S. Dollar Index rose 1% to close at 96.03.

From a market sector outlook, the discretionary consumer with +3.8%, information technology with +2.4%, and utilities sector with +0.9% were the only market sectors that finished higher. The energy sector with -5.2%, financials sector with -2.8%, the materials sector with -2.0%, and the industrials sector with -1.2% were the sectors that sank significantly

In terms of economic indicators, however, they were positive. Retail sales in October, capacity utilization and industrial production for October, the NAHB Housing Market Index for November, and the Philadelphia Fed Index for November were better than expected. Weekly unemployment claims were also showing improvement.

But investors took a cautious stance as the market hit record-setting highs and continued to buy shares of mega-cap companies to benefit from their steady earnings growth. In particular, NVIDIA (NVDA) rising 8.5% following positive financial results and forecasts.

As we've stated previously, stocks aren't afraid of inflation because they do businesses are in the pass-through mechanism. They have proven to be an excellent hedge against rising inflation. So long as companies continue to pass on prices, profit margins remain strong, and earnings are protected. Although equity is a real asset, earnings are a symbolic amount that is incorporated into these figures.

The following week is to be cut short due to the closing of the markets on Thanksgiving day and a short trading session on Black Friday. The economic calendar will include some news that could influence the market price action. We'll get the reports of the home sales in the month that ended in March.

Additionally, the week will end with a release of minutes from the Fed's meeting on monetary policy, which was held earlier in the month. At that point, the Central Bank expectedly announced the start of its program to reduce the number of its monthly purchases of assets.

Global market

Global equity markets were mixed during the week, and bond yields climbed to 6.2% year-over-year (y/y); data concerning U.S. inflation (a 31-year-high) was the main topic.

It is not uncommon for markets to wrestle with the rising pressures of inflation and supply chain issues across the globe and uncertainty over the future direction of global monetary policy.

European equity markets ended down, reversing earlier gains, due to COVID-19-related concerns considering following Germany introduced additional restrictions. Austria has imposed a new full-time nationwide COVID lockdown and mandated vaccination.

Although the Austrian lockdown isn't expected to last for more than 20 days, fears increased about the economic consequences as the restrictions and lockdowns may extend into other regions. In terms of economic reports, U.K. retail sales were up 0.8% month-over-month (m/m), higher than expected; however, they fell less than anticipated on a y/y base.

The U.K. FTSE 100 Index decreased 0.5%, while Germany's DAX Index and France's CAC-40 Index fell 0.4%. The Italian FTSE MIB Index declined 1.2%, and the Spanish IBEX 35 Index fell 1.7%, as did the Swiss Market Index leeched 0.1% lower.

Stocks in Asia were mixed in the end, with technology stocks in the red during Hong Kong after Alibaba Group Holding Ltd (BABA) failed to meet its top-and bottom-line estimates, and lowered its revenue forecast, and offered a negative outlook based on lower Chinese consumers' spending habits, challenging macro-economic environment, and a rise in competition.

Prices in Japan were lower than anticipated, but they were still positive since the y/y CPI recorded 0.1%, vs. the expected 0.2% gain. South Korea's producer inflation numbers were reported as 8.9%, the highest level in 13 years.

Next week's economic calendar for the international economy will include a variety of preliminary global December Manufacturing and Services PMIs. Other reports from around the world due in the coming week that may trigger some market reaction include:

- Australia - retail sales.

- China - Prime loan of one year and five years rate decision.

- Japan - November Tokyo data on consumer prices inflation.

- Eurozone - preliminary November consumer confidence, along with German November business sentiment.

- U.K. - retail sales data for October.

Market elsewhere

The currency market saw plenty of activity, with the Eurodollar and the Pound keeping traders busy. EURUSD experienced a sharp drop and fell to the lowest level in over 16 months. Meanwhile, The Dollar Index (DXY) rallied to levels not seen since July 2020.

Sterling also caught our eye when data revealed U.K. inflation jumped to a Ten-year record this month! In the emerging markets action, the Turkish Lira was the show star after falling to a new all-time low in relation to the U.S. Dollar.

Silver and gold consolidated recent gains moving lower over the week. The gold price dropped $20 from the previous Friday's close posted at $1845. The silver fell 70 cents to finish at $24.75 in the same timeline.

As concerns about inflation are now the dominant factor in the market, problems with credit systems are now on the back burner. As veteran credit market expert Doug Noland warns that instability in the global highly leveraged credit market could trigger the need for the next financial crisis.

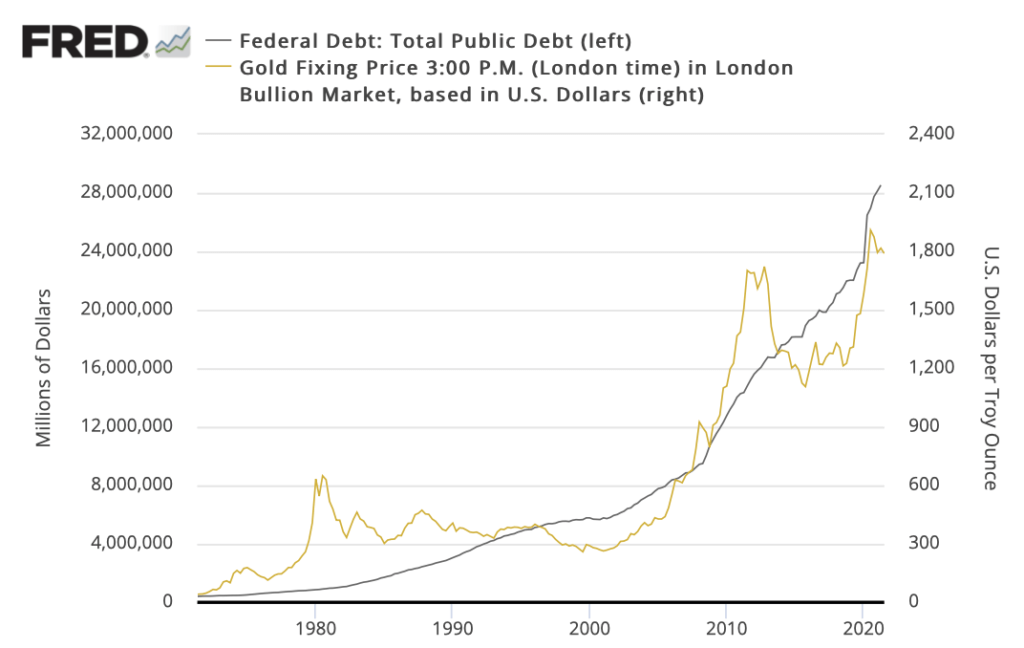

Note: As the sovereign debt has increased drastically, so is the well-documented impairment associated with it – to the U.S. Dollar, the economy, and financial markets. In parallel, the role of gold as an inwardly correlated hedge for portfolios has grown, as can be seen in the chart above. Few correlations in the market ring more true and more consistently than one between the national debt, now in the vicinity of $29 trillion, and the value of gold. Nevertheless, it is essential to be aware of the same conditions that led to the long-term trend of the nation's debt, and gold remains in place today.

Cryptocurrency market

The most popular cryptocurrency, Bitcoin (BTC) and Ethereum (ETH) seemed to have slowed their growth. Bitcoin fell to below $56,000 on Friday's session. As of this writing, Bitcoin is trading at the $58,500 range, down 15.2% from its record of $69,000 reached on the 10th of November. Ethereum trades at around $4,300, a drop of 11.6% from the record high of $4,869 in the same period.

Throughout the last two months, the Crypto Fear & Greed Index in the"greed zone" has sunk into the fear zone with the reading of 34. It might be wise to pay attention to Warren Buffett when he said:

"We only try to be scared when others are greedy and to indulge in greed only when others are scared.''

To determine the possibility of an upside breakout, traders and investors should look for the support levels posted here.