Weekly Market Review & Analysis For May 24, 2021

Overall the stock market had good play from the large, mid-sized, small, and even micro-capitalized areas. Risk assets seemed to draw support from the quietness of the US Treasury market, which prevented off-pestering inflation matters and related valuation concerns issues.

The Russell 2000 with +2.4%, the Nasdaq Composite with +2.1%, and iShares Micro-Cap ETF with +3.3% climbed more than 2.0% level. The S&P MidCap 400 posting +1.4%, the S&P 500 post +1.2%, and DJI Average with +0.9%, were indices each advancing within to 1.0% borderline.

From a market sector perspective, communication services (+2.5%), consumer discretionary (+2.2%), real estate (+2.1%), and information technology (+1.6%) were the sectors finished atop the in the standings. Oppositely, the energy (-0.02%), consumer staples (-0.4%), health care (-0.7%), and utilities (-1.6%) were the sectors closed in negative territory.

Making much of some of the economic numbers, which should help clarify the relative strength in the US Treasury market as the Ten-year yield dipped five basis points to close at 1.58%:

- Personal income faded 13.1% m/m from the last month, as the result of stimulus disbursements made was considerably reduced from March.

- New home sales dipped 5.9% m/m from the last month to a seasonally modified annual rate of 863,000.

- Durable Goods Orders surprisingly contracted 1.3% m/m from the last month.

- The Conference Board's Consumer Confidence Index dipped 0.3 points to post a 117.2 in the current month.

The statistics confirmed the thesis that economic growth percentages are peaking, which for their part would imply inflation rates are also topping. The latter was supported by longer-dated US Treasury yields drifting lower (not higher) to the resulting inflation news items:

- The study from the University of Michigan Index of Consumer Sentiment shows the anticipated year-ahead economic inflation rate was a record 4.6% in the closing of May.

- The Personal Consumption Expenditures (PCE) Price Index - the Fed's favored inflation gauge - was higher 3.6% yr/yr in last month

- Costco's CFO said, "inflationary factors abound" and estimated that all in all, price inflation level at the selling is the 2.5-3.5% area, or much higher from previous forecasts.

The problem that persists is will the inflation indeed be as transient as the Fed anticipates, notably when the additional fiscal stimulus looks to be rising on the horizon? Senate Republicans endorsed a $928 Billion infrastructure counter-proposal to the Biden regime's $1.7 Trillion American Jobs Plan.

In contrast, the White House approved a $6 Trillion budget for the fiscal year 2022, including the American Families Plan and American Jobs Plan - The US Treasury market seems to feel that way.

Market action elsewhere

Much of the global stock markets endured small gains in a week's session supported by mixed economic data. The numbers from mainland China were discouraged yet again, though the data remain strong; growth is solely normalizing to a pre-coronavirus movement. Backward-looking Gross Domestic Product (GDP) data from Japan and Eurozone revealed that Europe in a double-dip recession, and Japan is in danger of the same fate.

Nevertheless, forward-looking Purchasing Manager survey numbers were more upbeat (this what markets mostly care about). Lower trade hostilities also helped as the Eurozone agreed to delay plans to raise tariffs on many select US goods.

Gold and Silver market

Gold and Silver market maintained their rally this week, with Gold closing above the $1900 level and Silver challenging the $29 level. From last Friday’s close, Gold arose a net of $22.30, and Silver by 37 cents closing at $27.90. Gold caught a high of $1912.70 on Wednesday session on colossal volume, and Silver hit $28.23.

Gold and, to a larger extend, Silver, advancing higher, drawing closer to our Key Res of $1,950 level that, if broken, will trigger renewed Inner Gold Rally of $1,990 and on a rebound to the August peak high.

Aside from a US Dollar at its weak price level since the beginning of this year, the main point prompting the current rally is the Fed’s open-ended tsunami of liquidity stipulations which have hoisted the overall level of risk craving through its downward force on US Treasury yields.

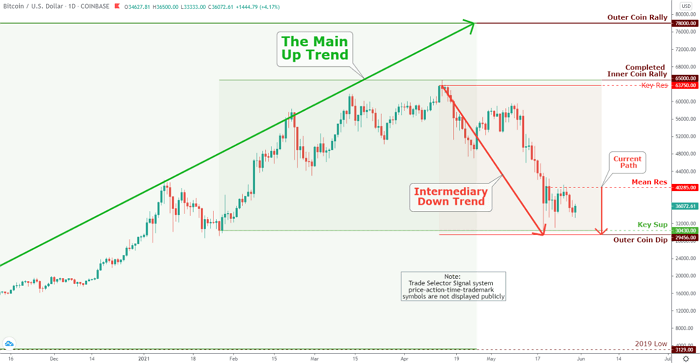

Bitcoin market

This week's crypto market feels like a roller coaster. Bitcoin was on its way up, but on Friday, the price has fallen to $35,000. What caused this dip? And what can we expect in the coming days?

So what happened this week? Last Sunday, Bitcoin reached a temporary bottom of $31,000. Since then, the price has bounced chiefly between $35,000 and $41,000. What's behind this week's price action? Yesterday the last Friday of the month that marks the expiration of 53,400 Bitcoin options contracts. But what does this mean?

With a Bitcoin option contract, you have the right, but not the obligation, to buy (call option) or sell (put option) bitcoin at a specific price. Depending on the current Bitcoin price, you can then make a profit even if the price drops.

The expiry of Bitcoin options contracts often causes volatility, a problematic word for price movement. Calls and puts have opposing interests: one group wants the highest possible price, the other group wants the price to go down.

Options traders can influence the price on the spot market, the place where you can buy and sell Bitcoin directly. This can be done at regular exchanges such as Binance and Coinbase.

The Bitcoin trading volume has been high for days, with almost $50 Billion (40.9 Billion Euros) traded in the last 24 hours, according to the latest figures from Coinmarketcap. Where will the Bitcoin price go this weekend? Stay tuned.

Technical Analysis and Outlook: As a famous saying goes: ''Buy when there's blood in the streets'' will be applicable once the Outer Coin Dip $29,456 and retest of the Key Sup $30,430 will be wholly fulfilled and confirmed with our BARC symbol (The BARC is a measuring tool when the market "falls in tune'' by presenting market ending dips moves and buying spots). The upside reward is Mean Res $40,285. Aggressive shorting can be implemented at Mean Res $40,285 to the above-mentioned Coin Dip and Key Sup markings.