Weekly Market Review & Analysis For May 11, 2020

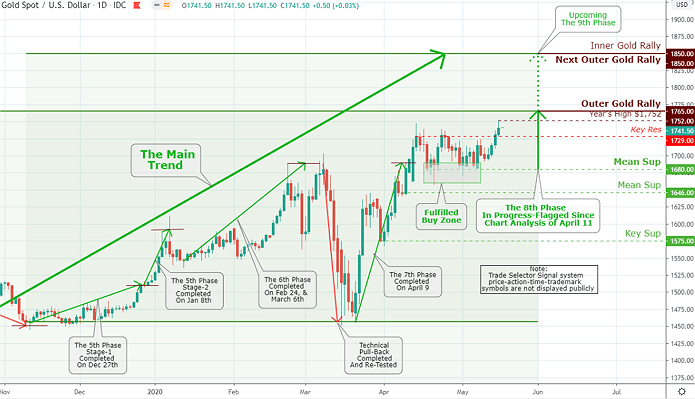

Gold market after more than a month of rangebound buying and selling finally succeeded in breaking the handcuffs that had held it around $1,700/oz. Gold’s breakout over Key Res $1,729 has helped the Silver with the Gold-Silver ratio dropping to 106 (one ounce of Gold to ounces of Silver), this showing is the lowest as of mid-March

Click the Image to Enlarge

They were granting that Gold traded to as low as $1692 this week, while investors and traders participants have observed a break above the key resistance and yearly high $1,747. The next key outcome levels for the Gold market to specified targets are Outer Gold Rally $1,765, and Outer/Inner Gold Rally $1,850. While the Silver shows Outer Silver Rally $17.0, Mean Res 17.45, followed by Key Res $17.60/oz.

The stock market

The equity market is a frenzied-depressive phase. It moves from oversold to overvalued every few days or so. The most simplistic market-timing system, consequently, is to be an absolute contrarian. Which involves buying stocks when everybody is selling and selling when everybody is buying. See https://www.tradingview.com/chart/SPX/lMcv9DHr-S-P-500-Index-Daily-Chart-Analysis-May-13/

The U.S. stocks finished lower this week, as anxieties about an economic V-recovery, United States-China strains, and stock valuations pressed on sentiment. The Russell 2000 index fell short with a hefty 5.5% drop, followed by more moderate losses in the DJI Average index posting -2.7%, broader S&P 500 showing -2.3%, and almighty Nasdaq Composite index print of -1.2% result.

This week's most vulnerable sectors were the vital S&P 500 energy sector posting whopping -7.6% loss, followed by real estate with -7.3%, industrials sector with -5.9%, and financials sector posting -5.7%. The vulnerability in the energy space developed despite robust gains in crude oil prices, which increased 18.8%, or $4.64, to close at $22.62 on Friday.

The health care sector with +0.9% gain was spared this week, backed by its defensive-oriented strength, and by the therapeutic progress being done versus coronavirus. Quidel, for example, received U.S. Food and Drug Administration approval for its coronavirus antigen (Ag) test. All significant stock markets in Eurozone declined as Brexit started to make news headlines again.

The United Kingdom and European Union negotiators hinted that the discussions were at a deadlock. That elevated the risk that the United Kingdom’s transition phase would end by the end of the year without a free-trade agreement, further hurting the region’s economy. Asian region markets considerably outperformed those in North America and Europe. Australian market even achieved a small gain.

The Wall Street action this week began with the Federal Reserve on Wednesday, and options expiration day on Thursday. So we were looking for more “fizz” than usual on Thursday (downside) and Friday as a covering rally.

Elsewhere, the U.S. Treasuries posted slight increases this week. The Two-year yield decreased one basis point to close 0.15%, and the Ten-year yield dipped four basis points to finish at 0.64%. The U.S. Dollar Index rose by 0.7% to close 100.36 for the week.

Bitcoin market

Will Bitcoin break the psychological level of $10,000 (9,240 euros) this weekend? Keep track of the Bitcoin price to find out! It has been an exciting ride thus far! Following an evident decline the day before the halving, Bitcoin managed to go substantially higher as projected by TSS. The price rose by a whopping $1,200 (1,000 euros).

The daily chart shows that Bitcoin is currently affirming some stability as of this writing at the $9,450 level after an expected fall as price approached $10,000 phycological level. That is to say, Bitcoin has developed a moderate Mean Res $9,755 in our daily time-frame.

Should the buyers break phycological resistance of $10,000 and completed Inner Coin Rally $10,060, a relatively fast move to next Inner Coin Rally $10,725 would be the target, even though Bitcoin hasn't traded at these prices since February of this year.

In summary

Gold and Silver metals exploded higher this week as we began to comprehend the terrifying impairment done to the world economy from multiple weeks of inactiveness.

The crude oil market, having recovered very strongly on production curtails, and a pickup in global demand will find a flattening soon as our chart of April 22 analysis shows strong resistance at $28.50.

Precious metals are in a position to rally much further on the safe-haven asset call and diversification needs. At the same time, foodstuff commodities will commonly stay suppressed on the risk of sufficient supply.