Weekly Market Review & Analysis For March 29, 2021

The S&P 500 market with +1.1% attained a new milestone this week by surpassing the $4,000 magical prices for the first time, even though the Nasdaq Composite was the out-and-out winner with a +2.6% gain. The DJI Average posted +0.2% and established an all-time high, though it barely finished the week session higher, while the small-cap Russell 2000 index advanced 1.5%.

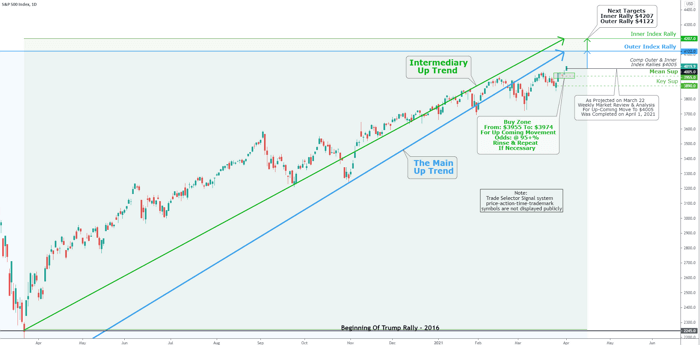

Technical Analysis and Outlook: The Inner and Outer Index Rallies were hit on April 1. The extended market targets are the $4,122 and $4,207 mark, respectively. Aggressive buying can be executed on a pullback at $3,955 - $3,974 with Rince and Repeat action as otherwise specified. The significant support level stands at $3,955.

Market Review continued

The week's market began on a cautious mark after Nomura and Credit Suisse warned of possible significant losses after one of their patrons, reportedly ill-famed Archegos Capital Management defaulted on substantial margin calls was obliged to dump more than $20B in stock holding in the previous week.

The financial plagues were rejected by tacticians, though, and several prominent American banks with Archegos vulnerability stated their losses were insignificant. The remainder of the week marked a market return of the heavily-weighted growth equities because of quarter-end rebalancing and first-of-the-month influx, a pullback from positive-minded analyst recommendations and long-term interest rates.

The leading information technology with +2.1%, consumer discretionary with +2.2%, and vital communication services with +3.4% sectors advanced the most this abbreviated week's session with gains over 2.0%. In contrast, the energy sector with -0.4%, materials sector with -0.3%, health care sector with -0.6%, and consumer staples sector posting -0.8% were the sectors settled in negative territory.

Cyclical stocks did less than expected despite the ISM Manufacturing Index for March increasing from 60.8% in February to 64.7% and the Conference Board's Consumer Confidence Index rebounding from 90.4 in February to 109.7 in March.

Market elsewhere

It was newsworthy to see buyers return to the U.S. Treasury market. The Ten-year yield rose two basis points to close at 1.68%, although it was teasing with 1.78% early in the week's session. The U.S. Dollar Index strengthened by 0.2% to close at 93.01.

West Texas Intermediate (WTI) crude oil futures ended higher with a $2.22 gain or 3.8%, to close at $61.24/bbl. The Petroleum Exporting Countries (OPEC+) Organization agreed to slowly increase output starting in May through July, with Saudi Arabia cutting its extra 1 million barrel per day production.

Gold futures contract settled higher with $12.80 or +0.8% to close $1,728.40/oz, helped in part by a softer U.S. Dollar and fading U.S. Treasury yields.

German stock market led European stocks higher, after posting fulling unemployment in March by more than anticipated numbers and manufacturing extended at its fasted pace in over two and have decades. United Kingdom stocks lingered as the country begins to ease its draconian lockdown.

Stock indices in the rising sun (Japan) nation was higher after much better-than-expected growths in the Tankan Large Manufacturers Index and manufacturing Purchasing Managers' Index (PMI) showing.

Cryptocurrencies

What an egg-citing end of this week for the crypto market! Do you remember last week's Bitcoin value that was about $51,300? Well, we can add $8,700 to that: Bitcoin reached a high of more than $60,000 and is looking suitable for the weekend price action.

And that’s not all. Do you happen to have some Ethereum? Then it’s your lucky day! Ethereum is off to an egg-celent start this Easter weekend, hitting a record high of slightly over $2,100 yesterday.

Easter symbolizes a renewal of life, faith, happiness, and freedom. I wish you all a Happy Easter.