Weekly Market Review & Analysis For June 8, 2020

Global stock market(s) pushed back this week, ending a strand of consecutive weekly gains that had eradicated big year-to-date losses for some significant stock indices.

The equity market began the week, scoring key milestones. The broad S&P 500 index became positive in 2020, and the tech-loaded Nasdaq Composite climbed above 10,000 level for the first time, however, surrendered to profit-taking that delivered it its worst trading week since March. The Nasdaq Composite dropped 2.3%, the S&P 500 index declined 4.8%, the DJI Average tumbled 5.6%, the small-cap Russell 2000 index sank 7.9%.

Market action

A majority of this week's damages came on Thursday session when the Spooz sank 5.9%: however, it recovered some losses on Friday session. There was no particular news agitator that contributed to the deterioration of the price. However, some accused the Federal Reserve of its wary June FOMC announcement while many others pointed to data figures bestowing increasing percentage rates of COVID-19 in many American states.

The Federal Reserve did not suddenly change its story, though, and the markets had elected to ignore the COVID-19 warning in recent weeks. IMHO, the stock market may have just advanced upward far too much, way too fast. The S&P 500 Monday's high had increased as much as 48% from its low on March 23, notwithstanding the darkness facing the economy.

All eleven S&P 500 index sectors ended the week with losses varying from 2.0% post in information technology to essential 11.1% in the energy sector. The cyclical, value and insolvent stocks that manifested strength early in the week's session were punished the hardest, while the mega-caps stocks showed relatively well amid a great deal of price point gains from brokerage firms.

At this week's Fed policy meeting, the central bank held the target range for the federal funds' interest rate constant at 0.0 to 0.25%, and its dot plot gestured that rates will linger near zero through at least to the year 2022. The Federal Reserve economic forecasts called for a 6.5% shrinkage in this year's GDP, followed by a 5.0% increase in 2021. Core Personal Consumption Expenditures Price Index (PCE) inflation is presumed to continue below the Fed's 2.0% mark through the rest of the year.

Elsewhere

U.S. Treasuries' assets closed the week with curve-flattening increases. The Two-year yield faded three basis points to finish at 0.18%, and the Ten-year note's yield decreased 20 basis points to close at 0.70%. The U.S. Dollar Index improved by 0.2% to close at 97.11. WTI crude oil tumbled 8.3% to finish at $36.24/bbl. The VIX (CBOE Volatility Index) spiked by 47% to end at 36.09, which by the way, indicated expanded hedging interest toward further stock market weakness.

All significant markets in the Eurozone and Asia-Pacific region lost ground. Eurozone markets underperformed the in North America's markets; however, Asia-Pacific stocks bettered for the week mainly because of a “catch-up” rally on Monday's session once they got their opportunity to belatedly respond to the previous Friday’s surprisingly (hot air) robust U.S. employment report.

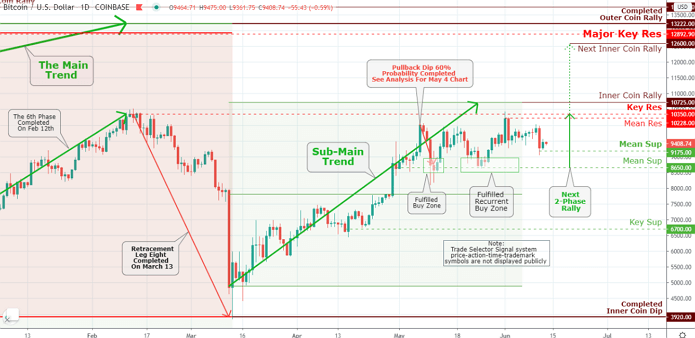

What a week cryptocurrencies had! In the last Wednesday's session, Bitcoin briefly experienced the sweet taste of crossing over $10,000 level. But, that did not last for very long, as the price of the digital coin collapsed in value sharply. In a nutshell, it has been a memorable week in the crypto market.

Click the Image to Enlarge

The Bitcoin did encounter significant resistance at the Mean Res $10,000, stopping investors longing to push the price above $10,000 and to a next Inner Coin Rally marked $10,350. The next 2 phase rally is in progress.