Weekly Market Review & Analysis For July 13, 2020

The market this week saw the Nasdaq Composite index go negative 1.1% as a capital outflowed from mega-capitalization technology stocks into value-orientating cyclical stocks. The broad S&P 500 index promoted +1.3%, trailing both the DJI Average with +2.3% and small-cap Russell 2000 index posting +3.6% in gains this week.

The influential banks got off on the higher note with the Q2 earnings season reporting large measures for credit losses, though that did not prevent investors and traders from buying in this unpopular space this week. The S&P 500 index financials sector market advanced 2.0% as a component of the rotational trade item, and it is worth stating that majority reporting companies did beat quarterly reporting outlook.

The industrials sector with posting +5.8% gain, materials sector with +5.4%, and the health care sector print +5.1% gained the most from this turnaround by climbing over 5.0%, deriving its energy from another step of exciting vaccine news.

Nevertheless, the market was quieted down by the negative route this week in mega-capitalization technology stocks, bothered by United States-China tensions, and a reversion in the re-opening process in California as a result of the climbing COVID-19 caseload. Also, the S&P 500 index's failure to stay above its Key Res $3,229 kept the bulls in check.

Netflix shares plunged whopping 10%, with a majority of those losses following the company announcement about cautious subscriber guidance by the end of the trading week. Amazon and Microsoft have retreated 7% and 5%, respectively, after showing substantial achievements in the prior trading week.

Market action elsewhere

U.S. Treasuries market traded around their flat price lines all week long. The Two-year yield decreased two basis points to close at 0.14%, and the Ten-year yield was unchanged, finishing at 0.63%. The U.S. Dollar Index weakened by 0.7% to close at 95.95. West Texas Intermediate (WTI) crude oil futures finished small, finishing at $40.56/bbl.

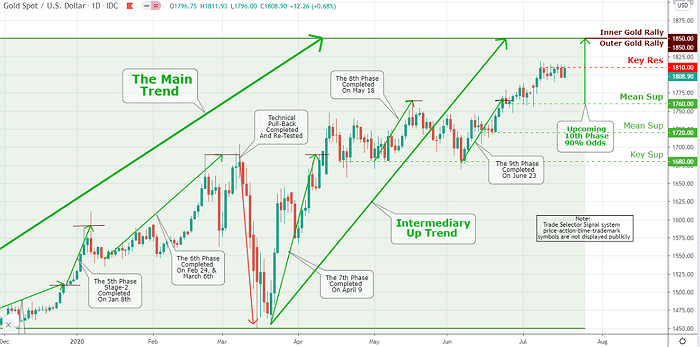

The Yellow metal is now in a long-drawn-out uptrend; basically, we see a change in the world as it unfolds. And the outcome of this at some point will manifest itself when the U.S. Dollar becomes cheap enough, and the price of Yellow metal gets high enough. All this will be a straightforward approach to a gold-backed currency or basket of currencies, such as Special Drawing Right (SDR).

Currently, the Gold is responding to the massive amount of U.S. Dollars being printed out of thin air. The progression into a Gold-backed monetary system is coming into place. Also, I would suggest paying very close attention to Silver. Silver is both an industrial metal and monetary metal, and the Chinese have been hoarding Silver for decades.

Click the Image to Enlarge

Every primary stock market in Eurozone was higher on the optimistic vaccine news reports. Though, the climate was wary as European Union (EU) bosses were deadlocked over the terms and conditions of a COVID-19 rescue fund going into this weekend summit conference. Economic data was diverse, with Eurozone area industrial production leaping higher in May; however, Germany’s ZEW investor sentiment poll slumping.

Markets in Australia and Japan climbed higher. The H.K. Hang Sang index dipped lower; however, the Shanghai Composite index dropped big, especially after China retail sales last month came in much softer than anticipated numbers. Also, the stock market in China come under pressure on multiple fronts: China-U..K. strains over the banning of Huawei Technologies Co from the U.K. 5G market, news of counter-sanctions from the United States and China over Hong Kong’s latest security law, and growing friction between China and Japan covering the South China Sea dispute.