Weekly Market Review & Analysis For January 4, 2021

The market record-setting spell that ended 2020 moved over to 2021 as each of the significant stock indices established closing and intraday record highs. The small-cap Russell 2000 was the big star this week with a decent 5.9% gain, followed by the tech-heavy Nasdaq Composite with +2.4%, broad S&P 500 +1.8%, and DJI Average finishing the group with +1.6%.

The S&P 500 market bettered the 3800 price level, the DJI Average surpassed 31,000, the big technology Nasdaq excelled over 13,000, and the Russell 2000 index for a brief time topped 2100.

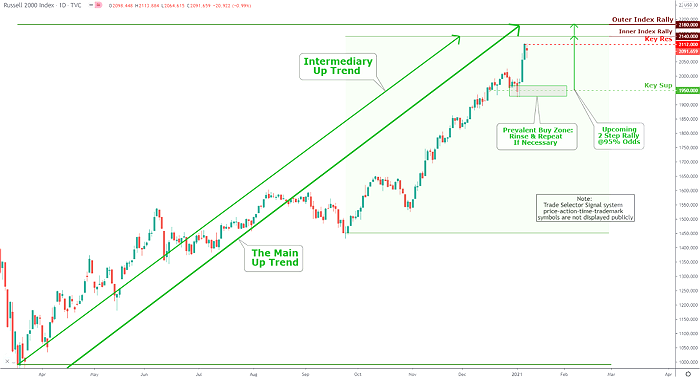

Russell 2000 Technical Analysis and Outlook

The small-cap Russell 2000 was the big winner this week. The index on its way to Key Res $2,112, and our Inner Index Rally $2,140 respectively, also, Outer Index Rally $2,180. The short-term downside support is tapped at Mean Sup $1,950 providing an excellent buying opportunity.

Click the Image to Enlarge

Market action elsewhere

The Ten-year yield market rose 19 basis points to close with 1.11% amidst intensified selling interest, which helped bank stocks however weighed on Gold prices, which closed down $1836.70/oz, posting -$57.00, or -3.0% for the week: with the NYSE Arca Gold BUGS Index diving by 5%.

Why the vicious plunge? Gold and Silver are different species because the big bullion banks who control the circus are especially short yellow metal on the futures market. BTW, we had this validated even more by the Commitments of Traders (COT) report. We noticed big bullion banks went short additional 14,000 contracts - Now that is very significant. Because these banks might not get their short positions covered in time, BTW, this illustrates why this collapsible starting on Wednesday has been so unnatural.

Bitcoin

Just last week, people were dancing on the streets to celebrate Bitcoin reaching $30,000. On Friday, the absolute record of almost $42,000 has been reached. The Bitcoin price has already doubled since breaching the old all-time high of 2017. The previous top now looks like an insignificant blip on the radar. How fast things can change! Welcome to the world of the Bitcoin market.

However, beware, there would seem to be several reasons to be skeptical of the coin’s intrinsic value. However, it was previously noted as untraceable, untaxable, and inaccessible to regulators, presently looking a bit deceptive. Then you have the environmental and security dilemma.

The most significant question mark though pertains to supply. The supply of Bitcoin is indeed restricted. It takes some great ability of an argument to insist that forking does not increase the supply. Nevertheless, the more significant issue is that the supply of a crypto coin in aggregate is virtually limitless.

The increase of new mines was remarkable during the last stage. With so much profit on the line, how much longer till we see Botcoin, Buttcoin, Betcoin, and... Batcoin each scrupulously restricted in supply, by all means?

And of course, once Uncle Sammy begins to feel beaten in the competition, which is to say the plug will not be pulled in a single night? And it can only be traded on regulated exchanges. Thus, outlawed and restrained can never be accepted as real money, at least not by We The People. The FOMO (Fear Of Missing Out) is not a problem, but FOOL (Fear of Outright Loss) is much greater.