Weekly Market Review & Analysis For January 11, 2021

The U.S. stock market encountered some selling demand throughout the second full week of trading this month, though not before the DJI Average and Nasdaq indices reached new record highs. The Dow and Nasdaq indices yielded 0.9% and 1.5% respectively for the week, while the broad S&P 500 index dropped 1.5%. Small caps stocks bettered notably, enabling the small-cap Russell 2000 index to post a +1.5% to finish the high-strung trading week with a notable gain.

The S&P 500 index consumed the first three session days of the week at a leisurely pace after posting a new historical high on January 8, while the Dow Jones and heavy-tech loaded Nasdaq climbed to new records as well. High-beta label stocks were particularly memorable, as the PHLX Semiconductor Sector Index (SOX) gained 1.9% while the IBB (iShares Nasdaq Biotechnology ETF) rose more than 2.0% for the current week.

The small-caps and high-beta stocks remained onward even as the rest of the broader market encountered some pressure for the last two days of trading before three day weekend. The losses were collected in some of the most significant components like Facebook, Amazon, and Apple, while much less powerful names and stocks benefited and outperformed from commodity inflation.

The vital energy sector declined 4.0% on the last day of the week's trading, but it still expanded by 3.1% for the week, extending its January progress to 12.7%.

The fourth-quarter reporting period was drummed out on Friday with much better than anticipated earnings from Wells Fargo, JPMorgan Chase, and Citigroup. Simultaneously, the Federal Reserve chief Powell reemphasized on Thursday, stating that the fed funds interest rate won't be raised for a very long time.

Market action elsewhere

The most significant market(s) in Europe were lower, notwithstanding Eurozone industrial production that exceeded its expectations and confidence from ECB (European Central Bank) President Christine Lagarde. European economic movement will bounce back as the virus pandemic subsides.

Thus far, Italy's stock market is turning a blind eye to revived political turbulence in that country. The current government, headed by Prime Minister Giuseppe Conte, is near falling after a junior partner has withdrawn from the ruling coalition.

In the rising sun nation, the coronavirus state of emergency was extended from the Tokyo region to seven more prefectures. Government officials are weighing whether to drop once again or delay the Tokyo Olympics event scheduled for 2021. Notwithstanding, the Japanese stock market rose after news that the government is considering a different pandemic relief package for its business and citizens.

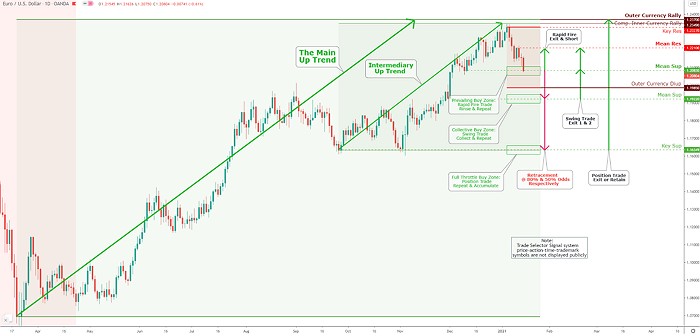

Eurodollar Technical Analysis and Outlook

The Euro retracement price action is in a corrective mode and well placed following completion of the Inner Currency Rally $1.2349, and marginally Outer Currency Rally $1.2370. Formation of Mean Res $1.2210 and Key Res $1.1173 are confirmed by Trade Selector System proprietary 'TARC' symbol - Trade accordingly/appropriate to your risk strategy.

Click the Image to Enlarge