Weekly Market Review & Analysis For December 28, 2020

First of all, a Happy New Year, and I hope this Market Commentary finds you smiling, in good health, and being in a very optimistic way of life - So live not in fear, but in faith, in 2021, we will breathe in the most exciting times this planet has ever seen - be happy.

The large-capitalization indices set new record intraday and closing highs in the final week of 2020. The broad S&P 500 index and DJI Average increased by 1.4%, and the tech-heavy Nasdaq Composite gained a small 0.7%. The small-cap Russell 2000 index pulled back hastily from record postings territory with a hefty 1.5% drop.

Beyond momentum, which could be said was the chief driver for the market, being helped this week with President Trump signing the disputed $900 Billion omnibus and stimulus spending measure. The United Kingdom approving the AstraZeneca and Oxford COVID-19 vaccine for emergency treatment and awaited Brexit. Neither news was particularly unexpected, though the stories were good enough for sentiment reasons.

Ten of the eleven S&P 500 sectors participated in the advance. The consumer discretionary sector with +2.0%, communication services, financials, and health care sectors gained +1.9% each, and the utilities sector with +2.5% outperformed the benchmark index. The vital energy sector with -0.4% was the lone die-hard loser and concluded the year with a whopping 37.3% decline.

It was no surprise; the market was not disturbed by Senate Majority Leader McConnell announcing that the $2,000 stimulus checks have "no realistic path" to pass in the Senate promptly. However, it could be retaken in the new Senate in January, though that is a topic for 2021.

It's also worthy of mentioning that the S&P 500 index finished the year with a respectable 16.3% yearly gain compared to the DJI Average of +7.3% but much less than the Nasdaq that posted +43.6% and the small-cap Russell 2000 index with +18.4%.

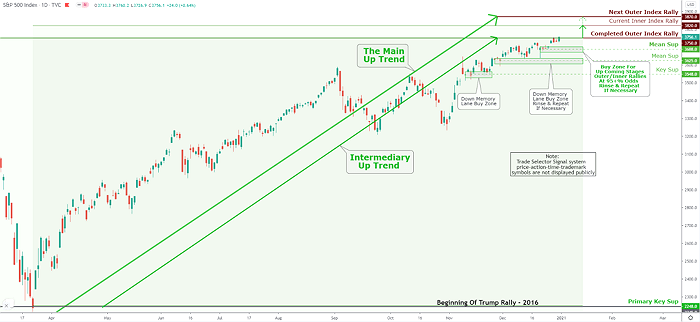

S&P 500 Technical Analysis and Outlook

The Index bounced off the Mean Sup $3,688 and marching-on to Current Inner Index Rally $3,820, followed by next Outer Index Rally $3,870. The current ''Buy Zone'' Mean Sup $3,688 and $3,625 stands as a unique chance for buying once the prices drop to these zones.

Click the Image to Enlarge

In the market action elsewhere

Meanwhile, in the bond market, U.S. Treasuries moved insignificantly higher, stretching the uptick seen from the prior session. As a result, the Ten-year benchmark note yield settled lower one basis point (which flows as opposed to its price) to close at 0.92%, moving down below 100 basis points for the turbulent year.

Within overseas trading, equity markets across the Asian-Pacific zone delivered another no great shakes performance on Thursday, with many markets closed down for New Year's Eve. Mainland China's Shanghai Composite Index climbed by 1.7%, while Aussie's S&P/ASX 200 Index fell by 1.4%.

The significant European stock markets went sharply lower in a shortened session, as all the German markets were closed on Thursday. While the United Kingdom's FTSE 100 Index dived 1.5% and the French CAC 40 Index slumped by 0.9%.

Bitcoin is way up, and the gold and silver market are up for the year as well. What's going on here? Is this the twelve-month cycle the U.S. Dollar collapses and plunges in a big way because of all the money being printed and election turmoil? The U.S. Dollar is being off more than 5% following the election in America. Will the big plunge strengthen in 2021? - Stay tuned.