Weekly Market Review & Analysis For April 20, 2020

The large-cap market indices decreased the first time around in three weeks, as delicate risk sentiment was kept well under control by the extreme volatility in the crude oil futures and valuation concerns.

However, the losses were not that large, though, with the DJI Average index suffering 1.9% loss, the broad S&P 500 dropping 1.3%, and the tech-heavy Nasdaq Composite falling 0.2%. The small-cap Russell 2000 index, though, advanced 0.3%.

The significant news event this week was when the oil price for the May West Texas Intermediate (WTI) futures contract crumpled to -$38 on Monday's session. The crude oil market below zero postings was the very first time in oil history, as no-one wanted to take physical delivery - reflecting storage limitations and lack of demand. The futures contract expired on Tuesday at $10 per barrow.

The remainder of the WTI crude oil futures curve was pulled noticeably more under, with the June WTI futures contract reaching as low as $6.50 per barrow at its low before climbing higher to close at $17 by week's end action. On a piece of related news, President Trump might have lightened some uneasiness concerning possible job losses in the oil industry after pledging to defend energy companies with suitable funding.

The resilience in crude oil following completion of TSS Outer Oil Dip, and President Trump's remarks, boosted the S&P 500 energy sector with a +1.7% gain and closed in the positive zone this week. As a matter of fact, it was the only index sector to finish higher, while the real estate posted -4.4%, utilities sector print -3.8%, and consumer staples sector closing with -3.2% - these were the sectors falling the most.

Market valuation matters likely added to the week's deterioration, based on a general perception that the S&P 500 index was up whopping 31.2% from its March 23 low levels coming into the week. The market rally was fundamentally driven on the hope that the COVID-19 and U.S. economy, won't be worsened than the numbers seen in March and April.

It was, however, this same optimism, though, that possibly explains why the stocks barely faded. Notably, though weekly initial unemployment claims revealed signs of lightening with job claims for the week concluding on April 18 and declining by 810,000 to 4.4 million.

Not only that, but the economy will also be supported by an additional $484B in stimulus money after the passage of a relief bill to cover small businesses, hospitals, and C-virus testing.

Each of which, some therapeutic optimism was somewhat discouraged after a piece of news that Gilead's Remdesivir drug failed in its first randomness clinical trial in China. Remark, this was a separate account from the clinical trial in Chicago that explicated promising signs.

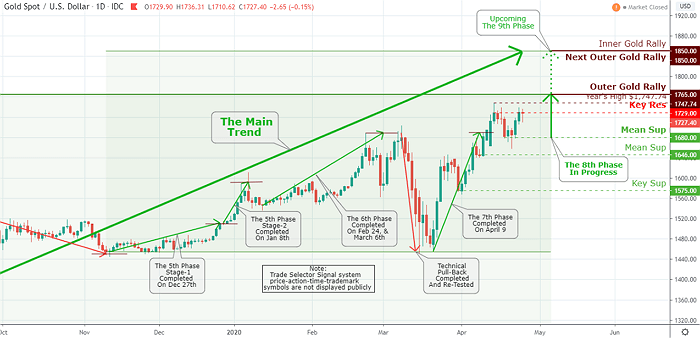

Precious metal marketThe Gold market advanced on the week, but the Silver metal was hardly changed. From previous Friday’s close, Gold surged $47 to close at $1,728, while Silver climbed five cents to finish at $15.23 on the week. While Silver metal still has plenty of catching up bring about, in percentage postings, it actually has bettered Gold since the middle of March sell-off bout. Nevertheless, for the year that still gives the Silver declining 14% for 2020 thus far, while Gold is up to excellent showing with 14%. |

Click the Image to Enlarge

×

The 8th phase rally is on the way with the Outer Gold Rally $1,765 mark, paused by Key Res $1,729. The initial Inner and next Outer Gold Rally is tagged at $1,850. The primary support level stands at $1,680. |

Elsewhere

U.S. Treasuries market saw small and limited action this week. The Two-year yield was unchanged, settling at 0.20%, and the Ten-year yield dipped five basis points to finish at 0.60%. The U.S. Dollar Index promoted by 0.5% to close at 100.25.