Market In Review & Analysis For April 1, 2020

The stock market finished the violent first quarter in the negative area yesterday. At the same time, traders and investors proceeded to assess the latest economic impact caused by the coronavirus fiasco and the policies boondoggle proposed to address its effects.

The S&P 500 index settled near session lows with a 1.6% drop after a short stay in a positive zone early in the trading session. The DJI Average index fell 1.8%, the Nasdaq Composite index dropped 1.0%, and the small-cap Russell 2000 index succumbed 0.5% on the day.

Away from the equities market, fixed income was lower; the green paper was more sturdy. The U.S. Treasuries Two-year yield dipped one basis point to close at 0.20%, while the Ten-year yield rose three basis points to finish at 0.70%. The U.S. Dollar Index dropped 0.2% to settle at 98.95. West Texas Intermediate (WTI) crude oil rose 1.5% to close $20/bbl, while in the session, it was up more than 8%.

|

The Gold lost about 3% versus Silver felling 0.5%. Today (April 1) is the first notice for the nearby Silver futures contracts market as the spread is currently back to approximately $15, so it is not as entirely out of place. The mining stocks were schizophrenic yet again, trading franticly higher and lower early on session before rolling lower for keeps. While they were fragile, the miners were in alignment with Gold, instead of being drastically more damaging, by the way, this is a small shift relative to their current performance. Separately, the Federal Reserve set a repurchase agreement means as an alternative source for global central banks to temporarily replace their United States Treasury securities for United States Dollars. This never the less was the most advanced "whatever it takes" effort by the Federal Reserve to maintain financial market stability. |

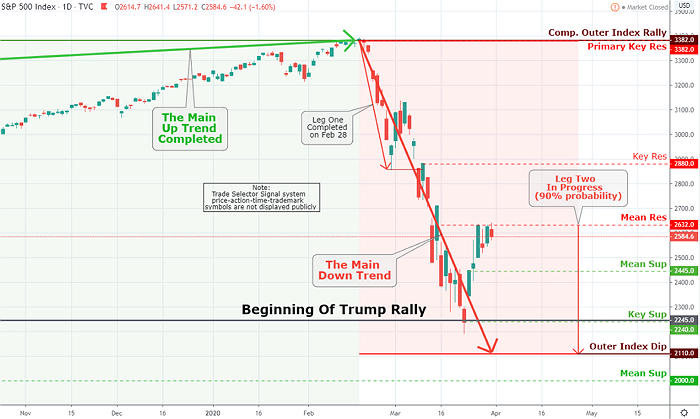

Click the Image to Enlarge

×

The Outer Index Dip $2,110 is progress. The main down-tend is currently in the offing - with the leg-two 90% probability. Mean Sup $2,445 and Key Sup $2,240 idling beneath. The intermediate resistance level is established at $2,632. |

The market will not experience V or U recovery

With the market being in the dull drums, no one should believe in a moment that once C-virus is stopped, we will experience a V-shaped economic recovery. IMHO, there won't be V or U, nor will we witness a hockey stick global economic recovery. What some people do understand, including the so-called gurus, is that there won't be any recovery what so ever.

What we are seeing is an extremely rapid deterioration of the world economy, which just pick-up steam and will be very devastating in the next half to one year, whether coronavirus ends quickly or not.

We see a textbook end to the current economic era

The conclusion of the current economic cycle is a textbook case. Bubbles are everywhere, significant difficulties in the global economy with financial and economic burdens bland in with a pandemic that has struck the whole world, all synchronously.

Next, we will see pressures in all the fiat currency systems as virtually all currencies will be devalued though not entirely at the same time. They eventually will all approach their intrinsic value of 'Zero' as global central banks drown the world with infinite amounts of money.

Hyperinflation will arise and then a total breakdown of the financial system as we know it. No one must think that the IMF issued Special Drawing Rights (SDRs) will heal the bankrupt financial system.

What SDRs will be is just another class of fiat money, and a monetary reset established on SDRs issued will have their moment glory for a few months before it all collapses again. The subsequent reboot after that will be messy and climactic as global central banks will lose total control.

Crypto News: Binance is set to acquire CoinMarketCap

According to anonymous sources, Binance is set to acquire CoinMarketCap for 400 million dollars. You probably know CoinMarketCap if you look at the prices on a daily base, although their cryptocurrency market price page is pretty cool too.

But seriously, the deal is expected to be announced this week. And when completed, that would make it one of the most significant acquisitions in the world of cryptocurrency. We’re curious how this will turn out! - Is this just an April fools’ prank? We will see.