Market Commentary April 10, 2019

The market(s) we are currently witnessing excessive display readings. In actuality, the latest two out of three occasions this occurred it top-ticked the entire global market.

There is frequently a struggle raging amid sentiment versus price action. At moments of ultimate pessimism, current price action resembles horrible conditions, and it is tough to imagine any purpose to buy long to intermediate term. Although, at times of radical optimism, anyone mentioning warning is mocked as a perma-bear or another silly name.

By late January of this year, some of the Trade Selector Signal models we watching had wholly revived from the last year's devastation, and some were even giving a very high level of optimism. While that has occurred previously, equities had a constant inclination to weaken over the following couple of months. However, this time, they ran right over all those essential readings.

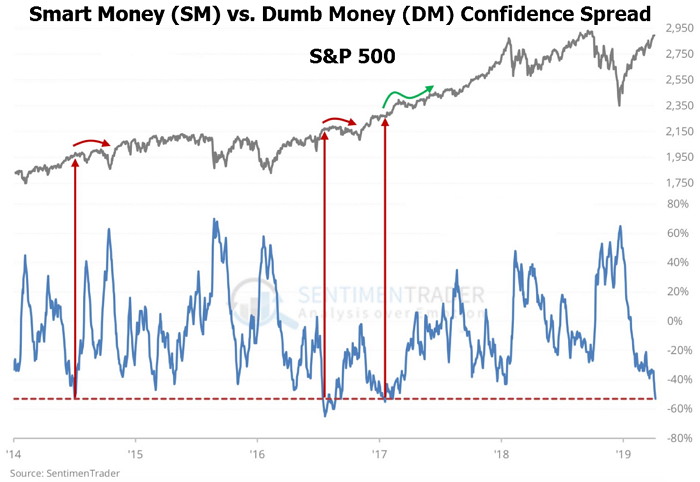

Moving along, we have registered a lot more market extremes, which by the way is normal for a steadfast uptrend, up to the point of course. However, beginning of this week, the spread between Smart Money (SM) versus Dumb Money (DM) Confidence declined under minus 50 percent.

So, over the prior 5-years, this has occurred three times, and what is so interesting the two occurrences essentially top-ticked the stock market, while the other most certainly didn't, and what's more the lone event was the forerunner to the rather unusual and robust 2017 uptrend.

Trading Signals On Demand And What Should You Know!