Market Commentary & Analysis For March 4, 2020

Last week’s stock market activity was very much fear-driven, while the high-frequency trading algos hijacked the markets. It was analogous to panic selling. The previous week's five-day trading rout on the global markets was overdone.

Treasury bonds rose, and stocks crashed in a flight to perceivable safety. Core metals started to slide as the truth of global factory closings took a grip. Crude oil prices collapsed.

For each hour, the market(s) were open last week for trading, the losses to investors, and traders were $97 Billion. Later in the week, the DJI Average was down over twelve percent. It was its most damaging trading week ever since the 2008 financial crisis.

When the broad S&P 500 index achieved at a historical record price closure on February 19, markets appeared to be unaffected by the fear around the coronavirus epidemic outbreak that had unnerved traders and investors in many other markets, including commodities, bonds, and additional foreign shares.

However, nine days later, a worrisome fact has set in. The broad S&P 500 index has just undergone its firmest-ever ten percent deterioration from accomplishing a record high price.

|

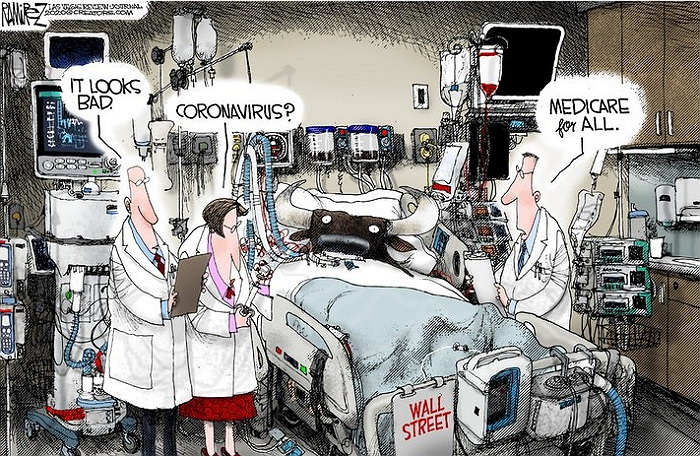

Traders and investors alike are indeed connecting the stock market wrecking ball to the coronavirus outbreak; however, we must be reminded that the coronavirus is not the problem of the downfalls but only the catalyst. Globally equities have been overrated and overvalued on many business models for quite some time. As a result, many companies CEO's are going to employ the virus as a justification to give us heads-up on earnings and revise them downwardly. It is a classic tailor-made justification. |

Click the Image to Enlarge

×

|

This too big opportunity to pass up for equities that are trading too actively ahead of earnings. So, now they have a solid as a rock cause for declaring loss in profits to investors.

Gold market

At the present moment, the Gold market looks unstoppable, with TSS Inner and Outer Gold Rallies rising in sequence and powerfully. Also, with global government finances shakedown, it's reasonable to expect that Gold will become the safe-haven asset, instead of a fiat-money denominated bond market.

One no longer has to be a hotheaded Gold bug to notice the likely destruction of fiat currencies all over the world by an eruption of government debt buildup.

At this time, portfolio allocations are suffering in a world that is entirely reliant on inflation and inflationary financing to prop up valuations of financial assets as precious metals such as Gold and Silver are not regulated investment vehicles.

The Gold has been notably on a few managers’ portfolios, so much that they have further diminished the importance of related investment assets.

The misapplication of risk-free investment assets into government bonds overlooks Gold, which is actually no one’s liability and is the outgrowth of forty-eight years of fully unbacked fiat monies.

In conclusion

At this time, we face a re-adjustment in investment ideas, and if stocks, bonds, etc. markets are on the brink of denying inflationism, the force of Gold, as well as Silver, should be climactic. Got Gold?