Market Commentary & Analysis For March 21, 2020

Historic market sell-off steepens as the global economy proceeds to shut down. Markets experienced wild swings this past week, eventually spiraling to lower levels as the accelerated spread of the C-virus continued to drive the economy to a shutdown state.

The DJI Average index posted a -17% decline and led the retreat, followed by the small-cap Russell 2000 index with -16%, broad S&P 500 index with -15%, and tech-heavy weighted Nasdaq Composite index posting -13%.

The carnage did not spare any market sector past week with all eleven S&P 500 index sectors suffering more than 11%, together with a 23% nosedive in the real estate sector. Trust and confidence were lacking amongst businesses, consumers, investors, and traders, notwithstanding additional stimulus shots taken by the Fed and ECB, given the extent of the situation.

For example, New York and California established stay-at-home restrictions. Many companies revoked guidance, suspended all dividends, and transitorily closed their operations, which led a great deal of many American workers without a job. The latter began to be quantified in the weekly post initial claims, which rose by 70,000 to a total 281,000 - week ending on March 14.

To bolster the financial system, the Federal Reserve cut the target range for the fed funds interest rate to 0% - 0.25%. It also lowered the discount interest rate to 0.25% and announced a $700B (Billion) QE (Quantitative Easing) plan.

|

Also, it expanded its daily repo transactions, set up facilities for money market mutual fund liquidity, commercial paper funding, and arranged their coordination with other major central banks to improve liquidity via standing United States Dollar liquidity swap line systems. Like a multitude of other stimulus measures was also adopted by other central banks, yet traders and investors continued to idle and wait for a robust fiscal response. U.S. Congress passed an $8.3B relief/assistance package that administers unemployment as well as sick leave benefits, and the Federal Housing Finance Agency halted foreclosures and evictions for two months for enterprise-backed mortgages. The $1T (Trillion) plus fiscal stimulus package bundle, which involves direct payments to Americans and help for small and large businesses, continued to be pondered. |

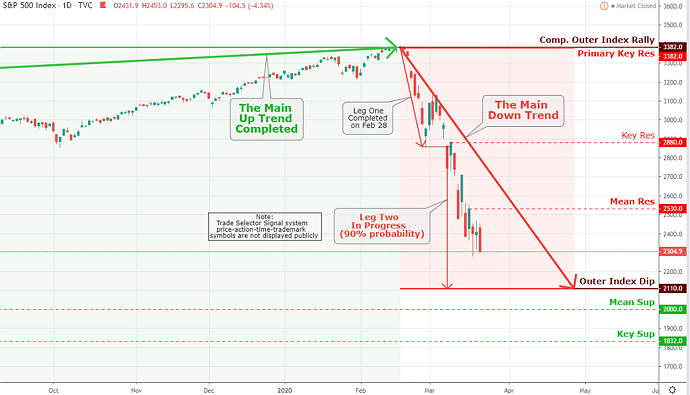

Click the Image to Enlarge

×

The Outer Index Rally $3,382 is complete. The main down-tend is currently in the offing. With the leg-two marked at $2,110- in progress, as Mean Sup $2,000 and Key Sup $1,832 idling beneath. The intermediate resistance level is established at $2,530. |

Other market activity

Crude oil market prices plunged 24% on one day, then bounced back 23% the next day following President Trump announced that he would get involved in the oil price war between Saudi Arabia and Russia at "the appropriate time."

The Wall Street Journal also published that the state of Texas was even thinking about cutting crude oil production. For the last week, West Texas Intermediate (WTI) crude still declined over 24% to close at $23.35 per barrow.

Separately, the Boeing company went through a very turbulent trading week with shares falling more than 40%. The company requested at least $60B of financial aid, including loan guarantees; and Reuters published a news story that the Boeing company is pondering a production halt.

Equally safe-haven assets market suffered heavy selling pressure last week as well in a move that hinted that traders and investors were raising cash, which paid to the 4.1% rise in the United States Dollar Index.

Gold metal declined 2.1% to close at $1498, and although longer-term U.S. Treasuries were down vast, however, they later recovered their losses. The Two-year yield faded 14 basis points to close at 0.37%, and the Ten-year yield decreased one basis point to post a 0.94% closure.

The cryptocurrency segment continued to impress on Friday's session and after displaying relative strength amidst the global financial turmoil as the leading crypto coins built up the strong bullish sentiment.

The Bitcoin was the apparent leader on Friday’s breakout from the mid to short-term solidification range, and the coin took on significant, influential Mean Res $6,600 level during the short-covering surge.

The granddaddy coin briefly penetrated its resistance trendline, however, given the immense level of uncertainty across all asset classes, I'm expecting a further explosive move in Bitcoin’s market.