Gold and Bitcoin as an alternative to depreciating fiat money

Gold and bitcoin in the investment world are the most conflicting assets. Many experts, millionaires, and analysts have debated whether gold or bitcoin will be the most advantageous store of value for the next many decades.

I recently wrote how the world's central banks appear to be a symbiosis of cash, which means there is no end in sight for the massive speculation we are seeing in markets today. It's part of the growing disconnect between the market and the general economy and how this scenario will allow us to include both gold and bitcoin in our investment portfolio.

As I see it, both gold and bitcoin should not be viewed as rivals fighting the battle for a place in our investment portfolio. There are similarities and differences, but they are fundamentally the same.

Each one has a different degree of the seven essential features required to maximize the value of an investment alternative within the selected acquisition assets.

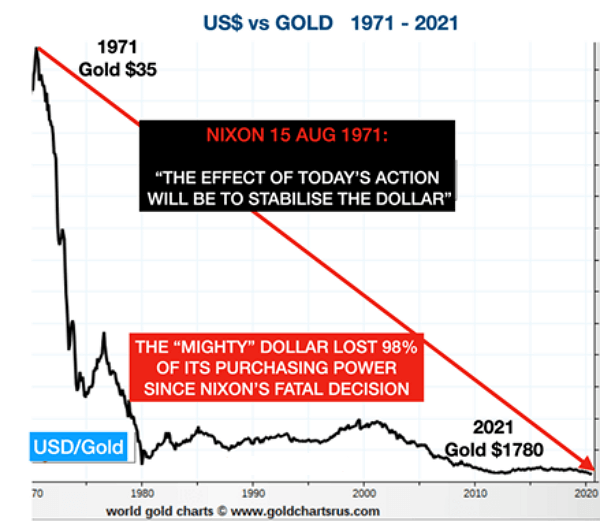

History: The gold bugs boast a long history of yellow metal compared to bitcoin's infancy. Gold was discovered over five thousand years back. It was used as a form of currency that was coin-shaped from the year 550 BC. From the period in the Roman Empire through the dissolution of the gold standard in 1971 in the good old U.S. of A. Gold's function in exchanging goods and services enabled global trade and helped ensure faith in the existing monetary system.

On the contrary, Bitcoin has been in existence since the year 2009. It certainly has a long way to catch up to the longevity of gold.

Rareness: Both gold and bitcoin have scarce importance of value. There are limits to their quantity compared to other assets, especially paper with ink over it.

Gold is, in essence, a rare commodity. The majority of known gold has been mined, with only 54,000 tonnes or 80% (of all known gold thus far) remaining to be extracted from the earth's surface. About 2,500 to 3,000 tonnes are mined every year at the current mining rate.

Bitcoin's rarity stems from its underlying programming code. At present, there are 18.9 million bitcoins available and a maximum of 21 million that is built in the crypto's code. Every four years, a process called "halving" induces inflation in the crypto's price by decreasing the number of coins in half in circulation and raising demand for the cryptocurrency.

The use-value: Gold is used in many applications. About half or precisely 47% of all the extracted gold is used in jewelry. About 40% of it is held in government and private holdings. Due to its superior electrical conductivity, it's frequently used by electrically powered apparatuses and will become increasingly valuable in the future as the area of sustainable energy grows further.

Bitcoin is changing what money is and the way we currently use it. Through various applications based on blockchain technology, the crypto provides access to financial services to a vast populace, including those who do not have access to conventional banking.

The store of wealth: Through the history of gold, it has been regarded as a safe-haven commodity asset and a hedge against inflation. This means that, as a long-term investment, the value of gold will rise greater than the U.S. Dollar or other fiat currencies in terms of its purchasing power. According to the historical stats, "twenty ounces of gold can provide you a very nice car, as it would have about half a century ago."

Bitcoin can likewise be a long-term investment store of value because of its high scarcity. When the limit of 21 million bitcoins has been met, that is it - No more coins will be created, which means that coins will be a lot more valuable later on.

Compare it with the world's most popular fiat currencies, where all central banks responsible for making and regulating these currencies don't have any real restrictions (aka printing out of thin air). They also produce fiat money that is not tied to any physical commodities.

So the more they print, the less the currency unit is worth - All main fiat currencies have lost 97 to 99% as opposed to gold since 1913 creation of the Federal Reserve. Therefore, gold and bitcoin are superior stores of wealth options for riches than fiat money.

Transactional easy: Both of these instruments are highly liquid due to the enormous demand from various sources. They can be easily transformed into fiat money or cash with relatively reasonably affordable and transparent exchange rates.

In general, bitcoin is a bit easier to convert via a myriad of digital crypto apps, but more steps are involved in converting the physical form of gold.

Bitcoin supporters consider the cryptocurrency as "digital gold," which is more investment-friendly and provides fast, safe, instant transactions without intermediaries or mega-banks, which takes a cut.

The authenticity: It is difficult to counterfeit gold. Bitcoin is also safe from theft or hacking by the secure nature of blockchain technology. That performs an immutable and vital transaction-verification operation. It is also increasingly utilized for data integrity functions beyond bitcoin and the other cryptos.

The bottom line for investors is that when you weigh the various factors, both gold and bitcoin have points for being suitable investments for the long-term growth of your tangible wealth.

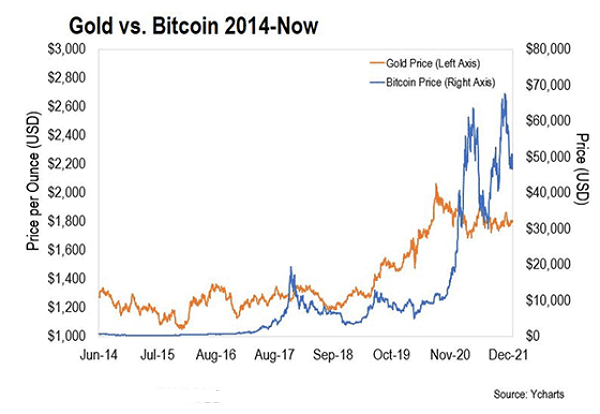

Volatility: Gold's price has indeed shown signs of volatility over time. But, it has also been able to gain the trust of investors. In contrast, even though bitcoin has displayed more volatility risk than other assets, bitcoin has also accumulated considerable investor trust.

Bitcoin has also earned higher returns, particularly in the more recent times, despite periodic painful plunges in price. Naturally, in the world of investments, volatility may represent an opportunity if you look at it through the appropriate Technical Analysis and Outlook information as I am currently providing for you.

The gold and bitcoin debate

The controversy between gold and bitcoin will not disappear within the foreseeable future. Time will be the final judge.

Consider the extent to which gold has advanced and how well it has performed over its long history. Consider how rapidly bitcoin has altered the financial and economic systems throughout its short time.

They reflect their respective environments: the gold emerging of the geological world and the physical one - bitcoin virtual and technological.

This is why I suggest having both. They share a common feature by bearing all their differences: they provide an alternative to the current fiat currency model. This common element is the most crucial in the current global financial environment.

As I've stated in previous essays, central banks and governments worldwide play a game using their currencies. They have created over $30 trillion worth of new fiat money following the 2008 financial crisis. This represents about 75% of their entire assets holding.

However, this kind of reckless money creation comes with a price - each unit of measure of their money declines in value and becomes worthless.

This will not change drastically regardless of whether the anxiety and uncertainty surrounding the Federal Reserve's monetary stability policy cause temporary market volatility.

While I am not saying that fiat currencies will disappear anytime soon, the central banks that create endless quantities of them will not radically alter their monetary policies anytime soon.

If the financial system has gold backing and more people choose to use gold, the best approach will be a combination of gold and bitcoin because gold is not an asset created by keyboard stroke.

Therefore, including both gold and bitcoin in your portfolio of long-term investments is a sensible option. Both have an essential role in protecting the actual worth of your hard-earned money in the long run.

This article was printed from TradingSig.com