With economic value, don’t be fooled by nominal prices

Don’t let economic value pricing information confuse you regarding the value; it offers three such values that affect our economy, bonds, currencies, and stocks.

At this time, there are economic value variables affecting bonds and stocks. These variables prevent them from functioning as they normally would. The market for both of these values is determined by those who decide to buy and sell them. The balance comes into play when the supply and demand for them match up.

Bonds are administered through central banks. They help to regulate the interest rates. For stocks, various firms involved allow the cash flow to take place. A few of these major players are Vanguard and Blackrock.

They are interested in keeping momentum at a peak; they don’t care about the stock's economic value or quality. This is why the bonds have more clout due to the control the central banks offer over them.

Economic value and recession

The declines of both stocks and bonds regarding their economic value have some speculating what will happen in the future. Expert’s share those declining values aren’t going to hold for the long-haul, though, and they will go back up. The Federal government helps to balance this with their mandates and their control over market values.

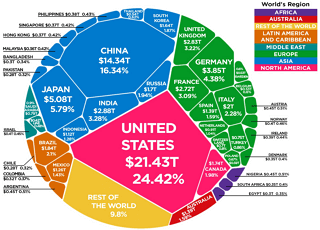

As a whole, currency around the globe continues to deteriorate and become worthless. We are in a recession, and the harsh economic times have taken a toll. Businesses worldwide have accumulated losses equaling trillions, and that is just looking at the previous six months' losses. Sadly, such losses are going to continue into 2021.

If the markets with stocks and bonds aren’t going to fail, do those losses affect the economic value? The currency market is where it all flows through. This means the value of all types of paper currency worldwide will take the hit for the economic losses in society. This is referred to as Global Synchronized Currency Devaluation.

The price of gold is a prime example of this. Gold is a way to keep the value of paper currencies higher. When the price of gold increases, the value of the paper currency is declining. Other examples include the cost of various commodities.

We pay more at the grocery store. We pay more at the gas pumps. It all trickles down to the consumer when businesses lose money. The commodities to look closely at include: Coal, copper, corn, crude oil, and uranium.

The increases add up fast, especially for those on a fixed income or a tight budget. Paying more for food or medications can be hard to cover when you are already spread thin financially.

Many view it as the prices going up, but in reality, the currency's value is going down. Stocks and bonds gain support with inflation, but fiat money doesn't. This is why many refer to the currency as the relief valve.

Make sure you carefully assess your decisions to invest in any of the following during this recession: commodities, gold, silver, goods, hard assets.