Are Crypto Currencies Symptomatic Of The Economy?

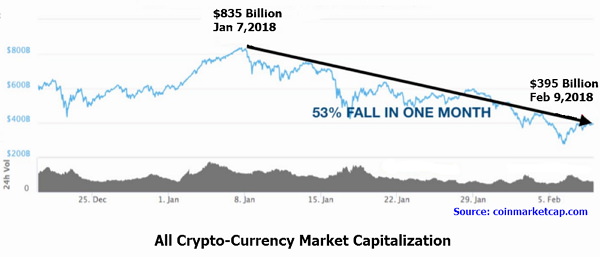

The price action that the crypto, as well as equity markets, have provided during the last couple weeks is an unmistakable signal that the euphoric period of the economic climate is coming to the last breath. It started most abundant in a prominent bubble of all time beginning to explode - CC's (Crypto Currencies). In a single thirty day period, the marketplace capacity of this marketplace was cut in more than half from $835 billion to $395 billion (currently is rebounding somewhat).

Crypto Market Is Unbelievable Speculation

Crypto currencies happen to be unbelievable speculation to the number of which were able to cash in. However, for numerous, it has been a devastating Ponzi scheme which will result in tears. CC's have absolutely nothing to do with actual investments and also less to do with capital preservation. There isn't anything terrible by having a tiny flutter in a speculative financial instrument. Unfortunately, though, numerous buyers of CC's have been lured to buy on credit, and so they are sitting on severe losses.

The fall in CC's is symptomatic of the tail end of the era. In comparison to an $80T (Trillion) global market, crypto's are modest play. Equities, as well as CC's, have one element in common, both of them have a long way down from the current state. Although CC's may go to nil, equities retrospect will go down in real circumstances by way of at least 90%.

I only say realistic terms due to the fact hyperinflation may take the moderate level of equities a lot higher. In between 1929 -1932 market crash the DowJones tumbled by 90% of its value. Within any criteria, the equity market bubble is extremely a lot greater nowadays, therefore the moment this market has topped, the coming decline will undoubtedly shock the whole world.

In Conclusion

What is next? Keep an eye on Gold. The best safe-haven asset during times of economic as well as geopolitical uncertainty. Prices indeed should have raised as a result of the latest enormous Wall Street sell-off. On the other hand, the prices were not allowed to rise because increasing interest rates which make non-yielding Gold much less appealing.

At present-day, Gold prices are heading higher. Should prices all of the sudden make a surprising rapid jump and become stable above the $1,450 level, it is going to show significant stock market panic which will override increasing interest rate worries, pushing Gold prices higher by a few hundred dollars at least.

Related articles

Trading signal service for you!

News Blog