Trading Chart Of The Week March 2018

Note: Trade Selector Signal (TSS) system price-action-time-visibility is not displayed publicly.

USD/CAD 2018.03.16USD/CAD pair has clambered above our entry level throughout March 15 and stayed there within a narrow range on March 16 morning session. That suggested a continuation of the uptrend; our stop/loss was moved to 1.30680 to minimize the risk. The new stop/loss eventually was triggered

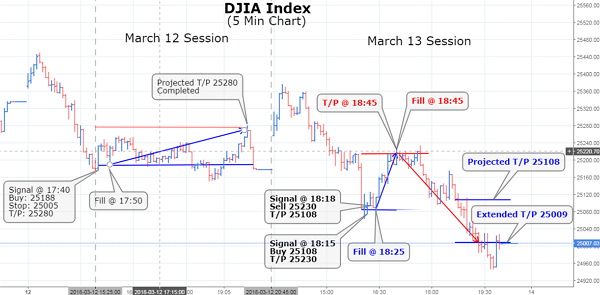

USD/CAD 2018.03.16USD/CAD pair has clambered above our entry level throughout March 15 and stayed there within a narrow range on March 16 morning session. That suggested a continuation of the uptrend; our stop/loss was moved to 1.30680 to minimize the risk. The new stop/loss eventually was triggered DJIA Index 2018.03.13The indices generated robust gains at the beginning of a trading session with the Dow Jones up almost 200 points at one stage. But, as we know, this rally was not to survive, and anxiety all around the continued trade war chatter, profit-taking in the technology sector and a pick-up in volume trades into the final hour

DJIA Index 2018.03.13The indices generated robust gains at the beginning of a trading session with the Dow Jones up almost 200 points at one stage. But, as we know, this rally was not to survive, and anxiety all around the continued trade war chatter, profit-taking in the technology sector and a pick-up in volume trades into the final hour DJIA Index 2018.03.12Dow Jones Index has shown an excellent upward direction after opening steady to lower on Monday trading session. The primary Index tips its hand and is progressing bullishly to our T/P level. This will be a hell of a week for equities. We have Option quadruple expiration on Friday this week, and with the Dow Jones very close the same price levels as in February, the market does not expect too much out of the ordinary until the following Monday (March 19)

DJIA Index 2018.03.12Dow Jones Index has shown an excellent upward direction after opening steady to lower on Monday trading session. The primary Index tips its hand and is progressing bullishly to our T/P level. This will be a hell of a week for equities. We have Option quadruple expiration on Friday this week, and with the Dow Jones very close the same price levels as in February, the market does not expect too much out of the ordinary until the following Monday (March 19) USD/JPY 2018.03.12The Yen has added incremental value against the US Dollar so far. Japan's currency hit our projected T/P price of 106.415, and the currency may be ready to strengthen further. Therefore I'm issuing buy signal @ 106.115. For more details see the Live Signal page

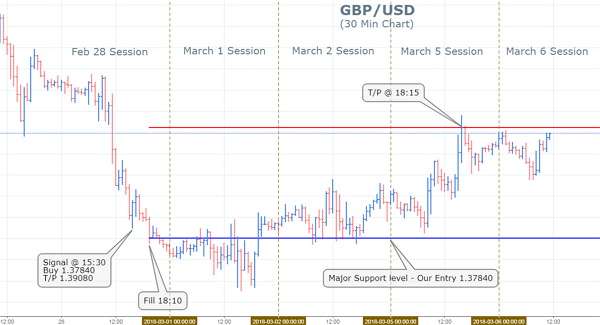

USD/JPY 2018.03.12The Yen has added incremental value against the US Dollar so far. Japan's currency hit our projected T/P price of 106.415, and the currency may be ready to strengthen further. Therefore I'm issuing buy signal @ 106.115. For more details see the Live Signal page GBP/USD 2018.03.09Thursday ECB released plans to normalize monetary policy which helped the rise in the Euro Dollar. GBP/USD pair was also heavy as it followed the Euro Dollar lower in favor of the Greenback

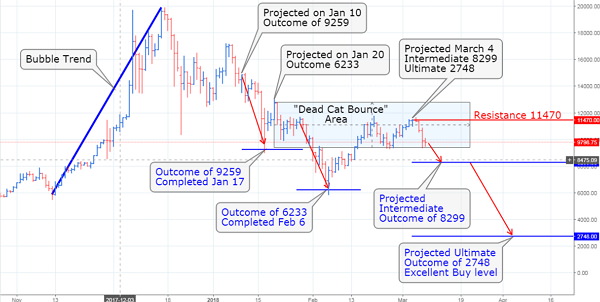

GBP/USD 2018.03.09Thursday ECB released plans to normalize monetary policy which helped the rise in the Euro Dollar. GBP/USD pair was also heavy as it followed the Euro Dollar lower in favor of the Greenback Bitcoin 2018.03.08Is Bitcoin breaking out to the upside? Sure does not look that way to me as we tend to make investments based on the concept of TSS “Price Action versus Time.” However, if this is the case, we expect the financial talking heads will begin to run Bitcoin breaking trend stories (heading down in a couple of weeks). To grasp where the crypto markets are heading? Follow the Price-Time trend lines, not media lines.

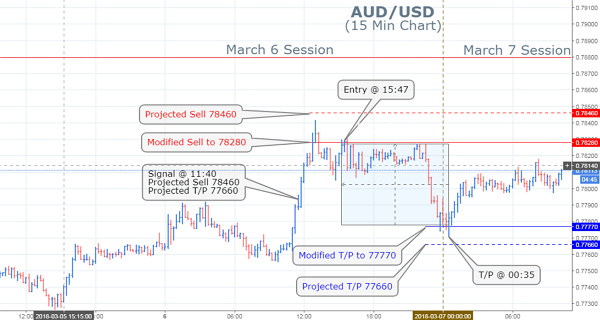

Bitcoin 2018.03.08Is Bitcoin breaking out to the upside? Sure does not look that way to me as we tend to make investments based on the concept of TSS “Price Action versus Time.” However, if this is the case, we expect the financial talking heads will begin to run Bitcoin breaking trend stories (heading down in a couple of weeks). To grasp where the crypto markets are heading? Follow the Price-Time trend lines, not media lines. AUD/USD 2018.03.07The AUD/USD pair has continued to slide down early this morning falling below the 0.77770 support and is now looking to extend further passing my original projection of 0.77660 to find some support at 0.77500. However, as the bulls are looking more in control expectations are building, and we could see further press upward to resistance levels at 0.78350 and 0.78700. On the flip side, if the bears might come back into the market, the solid 0.77500 support will be crushed.

AUD/USD 2018.03.07The AUD/USD pair has continued to slide down early this morning falling below the 0.77770 support and is now looking to extend further passing my original projection of 0.77660 to find some support at 0.77500. However, as the bulls are looking more in control expectations are building, and we could see further press upward to resistance levels at 0.78350 and 0.78700. On the flip side, if the bears might come back into the market, the solid 0.77500 support will be crushed. DAX Index 2018.03.06German equities gap-up forcefully on Tuesday trading session, tracking overnight incomes on US futures as well as a good trend throughout Asia-Pacific region as concerns about an impending trade war eased-up. The benchmark DAX Index increased 122 points (1%) at 12,212 in opening following rallying 1.5 % in the last session on Monday. We did take the great sell signal for whopping 115 points paycheck on the day.

DAX Index 2018.03.06German equities gap-up forcefully on Tuesday trading session, tracking overnight incomes on US futures as well as a good trend throughout Asia-Pacific region as concerns about an impending trade war eased-up. The benchmark DAX Index increased 122 points (1%) at 12,212 in opening following rallying 1.5 % in the last session on Monday. We did take the great sell signal for whopping 115 points paycheck on the day. GBP/USD 2018.03.05The Pound has been proclaimed as the loser with the recent past once more repeating itself as well as causing a complete absence of traders attraction towards the British Pound. The 2018 Q1 outlook from the investment sector anticipated that the GBP/USD pair could fall to 1.40 handle by the end of the first quarter, with this progress taking place in month March we are almost there

GBP/USD 2018.03.05The Pound has been proclaimed as the loser with the recent past once more repeating itself as well as causing a complete absence of traders attraction towards the British Pound. The 2018 Q1 outlook from the investment sector anticipated that the GBP/USD pair could fall to 1.40 handle by the end of the first quarter, with this progress taking place in month March we are almost there Gold 2018.03.01Gold has not yet come across the safe-haven bid usually connected with dropping stock markets however we did see a bid returning for long end bond market

Gold 2018.03.01Gold has not yet come across the safe-haven bid usually connected with dropping stock markets however we did see a bid returning for long end bond marketGOT SOMETHING TO SAY:

Archives

Charts Of The Day February 2018

Charts Of The Day January 2018

Charts Of The Day December 2017

Charts Of The Day November 2017

Charts Of The Day October 2017

Charts Of The Day September 2017

Charts Of The Day August 2017

Charts Of The Day July 2017

Charts Of The Day June 2017

Charts Of The Day May 2017

Charts Of The Day April 2017

Charts Of The Day March 2017

Related Pages

Trading signal service for you!

Live Signal