Trading Chart Of The Day January 2018

Note: Trade Selector Signal (TSS) system price-action-time-visibility is not displayed publicly.

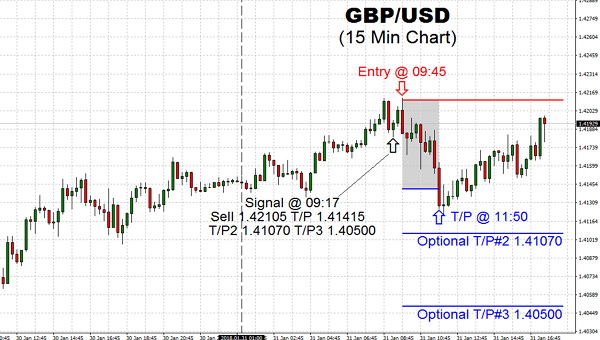

GBP/USD 2018.01.31

GBP/USD 2018.01.31After the initial rise this morning, the British Pound tried to bounce higher but did not get very far before the rally fizzled. No follow-up downside progress after hitting our first T/P of 1.41415

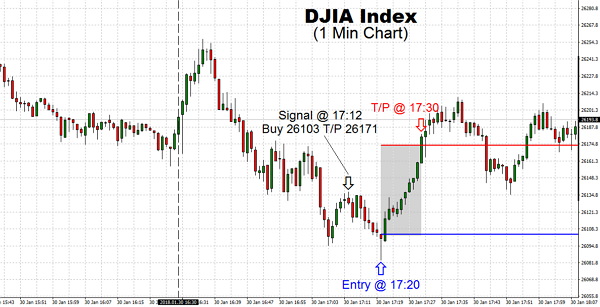

DJIA Index 2018.01.30

DJIA Index 2018.01.30The DJIA Index continued to be bullish overall but had a sharp move-steady to lower during this morning session. However, we are starting to see stagnation, once the Index reached our Take Profit price, and it’s likely that we will see pull back to 26103 area once again

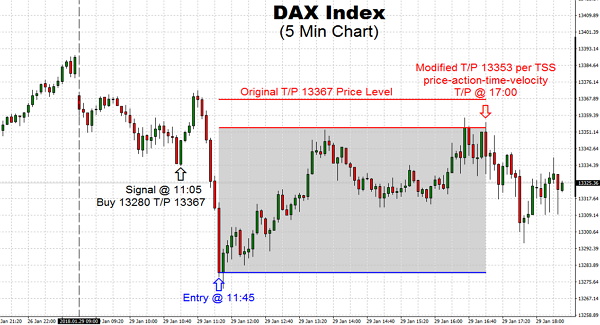

DAX Index 2018.01.29

DAX Index 2018.01.29The DAX Index had an active day today as the inverse correlation between the Euro and the DAX Index continued since Friday. The Euro-Dollar has been moving lower on the back of US Dollar strength. However, this has helped the DAX Index to move higher following steady to lower move from the open

Gold 2018.01.26

Gold 2018.01.26Bullion banks and commercials are extremely short the Gold market, which may lead to a few short-term volatility to enable them to carry out some short covering. Despite the pullbacks, the Gold market has witnessed an outstanding rally, and a response won't do anything whatsoever to disrupt the longer-term trend, which is going to be higher for quite some time

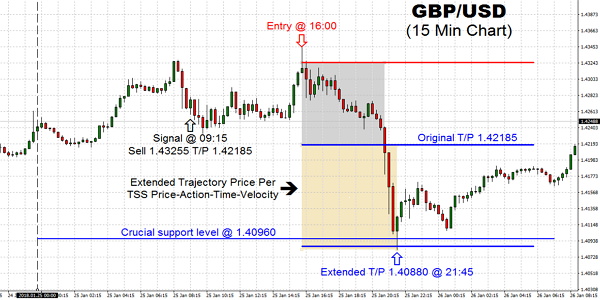

GBP/USD 2018.01.25

GBP/USD 2018.01.25The GBP/USD pair rallied during the trading on Thursday, attacking the 1.43 handle swiftly. This is a zone that of course did attract some attention, such as comments from the Trump at Devos which was used to bully significant currency markets

Chart Update From Jan 23: DJIA Index 2018.01.24

Chart Update From Jan 23: DJIA Index 2018.01.24Stick with the drill – exercise trading with awareness, alertness, and patience

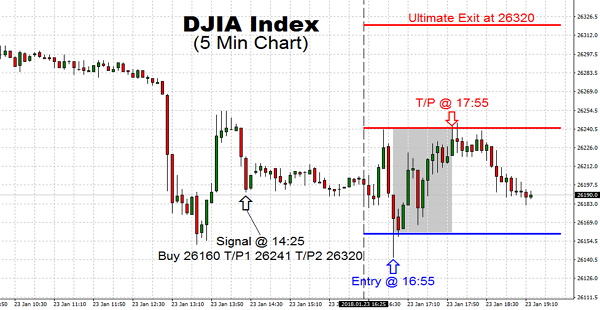

DJIA Index 2018.01.23

DJIA Index 2018.01.23The primary trend is up. The uptrend was reaffirmed earlier this morning when the market retested overnight strategic price. Given the prolonged price and time action, today’s session begins with steady to low with the entry of 26160 and ultimate exit at 26320

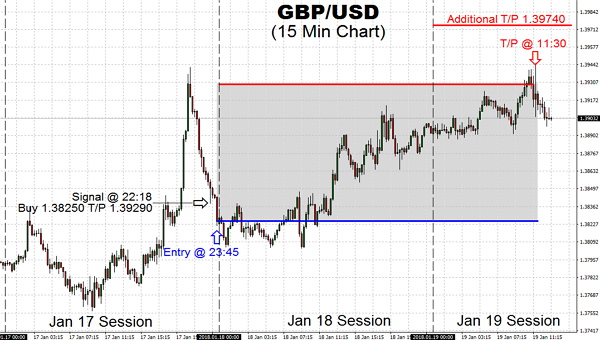

Update GBP/USD 2018.01.22

Update GBP/USD 2018.01.22Trading momentum with GBP/USD pair continued today as projected on Jan 19, with letting your profits run hitting T/P 1.39740. Next target for GBP is 1.40530

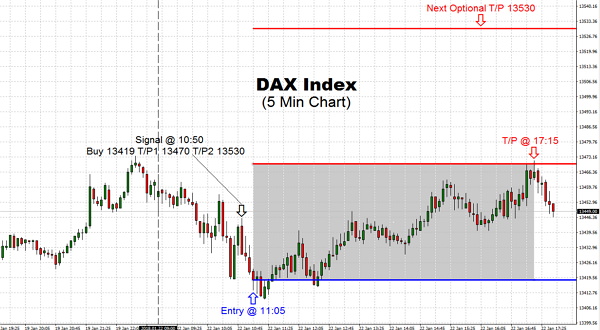

DAX Index 2018.01.22

DAX Index 2018.01.22The DAX pushed steady to lower on Monday trading session and give us the opportunity to go long later in the morning with the attempt to break through the 13450 level, which should provide a lot of encouragement for the bulls in the coming hours/day to shoot for 13530

GBP/USD 2018.01.19

GBP/USD 2018.01.19Trading momentum with GBP/USD pair continues to enjoy bullish move, despite being knocked back from $1.39290 Take Profit target. Let your profits run, and make the most of it by aiming T/P 1.39740

DJIA Index 2018.01.17

DJIA Index 2018.01.17Trading DJIA Index saw steady to lower opening today with the Index trying to exceed the psychological 26,000 level on the open. Plenty of talks that the recent 1,000 points had taken just seven trading sessions to accomplish it

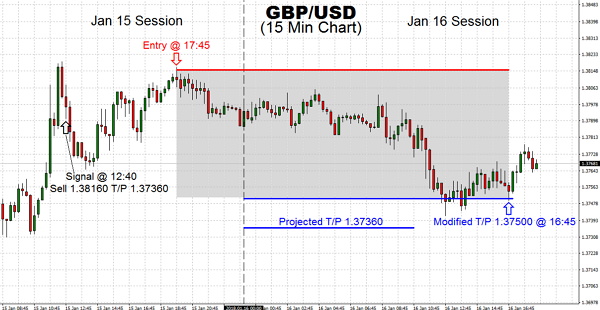

GBP/USD 2018.01.16

GBP/USD 2018.01.16In trading, GBP/USD we saw the $1.38 level broken for the first time since June of 2016, as the rally went on for a while on Jan 15. A drop towards our T/P $1.37360 did not materialize following day on Jan 16. However, price-action-time-visibility signaled exit at 1.37500 to maximize our profit; the lower target is continuing to be valid

GBP/USD 2018.01.12

GBP/USD 2018.01.12The trading pair at first went higher by reaching for the 1.36390 and then 1.36860 level during the Friday’s trading session and later encountered enough weakness to lower hitting the 1.36130. Short-term spikes in the currency offered excellent selling opportunity. The 1.36860 level above is extremely resistive, and lots of noise is anticipated therearound

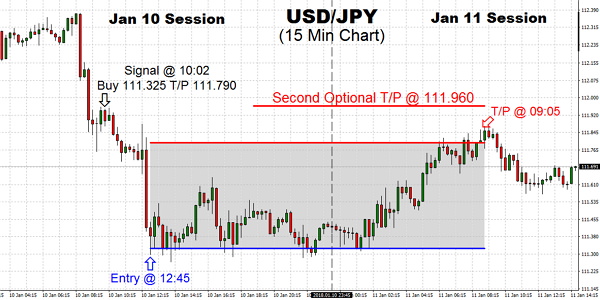

USD/JPY 2018.01.11

USD/JPY 2018.01.11The decisive move in the Japanese Yen, which traded back to the low 111’s as speculation that the BOJ (Bank of Japan) is removing the punch bowl, as a result in rising rates supporting the currency. This news weighed on the rebound which TSS trade is flagged as shown above

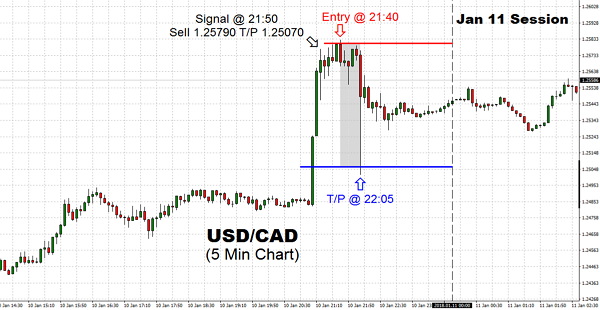

USD/CAD 2018.01.10

USD/CAD 2018.01.10The USD/CAD pair has been rocked as a result of fundamental and also political news report coming from both sides of the border, this also resulted in the currency pair spiking higher through the 1.25 level, triggering TSS short sell signal for pinpoint entry and exit

Gold 2018.01.10

Gold 2018.01.10Gold has experienced a several-week streak of performing well but not retracing much. These days we have to observe where it digs in where the next leg of the up push ends up. That would ultimately be the occasion when the rebuying will apply. I realize I have been a broken record on that subject matter, but it's what I feel, and I have not changed my mind.

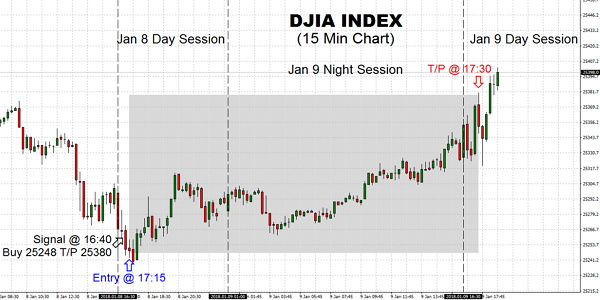

DJIA Index 2018.01.09

DJIA Index 2018.01.09New all-time high has been seen here for DJIA, and therefore we should expect this trend to go on. Although the Index finished mixed, the uncertainness, we got in new purchasing on the VIX, if this buying persists at least the market end to be a one-way bet!

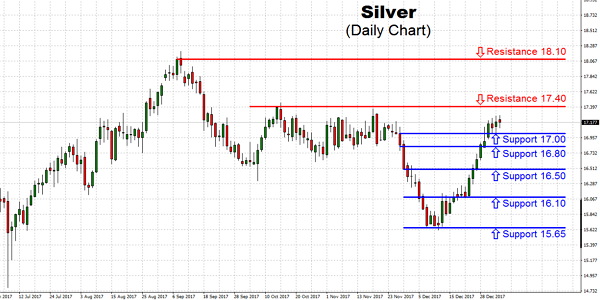

Silver 2018.01.05

Silver 2018.01.05Silver is trading well. Each correction is bid,so there is apparently a ton of money on the sidelines. Investors begin to see the train leaving the station, and they hop on at the lower possible price

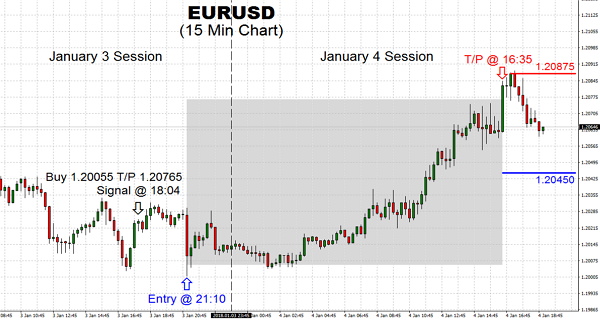

EURUSD 2018.01.04

EURUSD 2018.01.04The entry price from yesterday dictated the state of trading for today,hitting out T/P price of 1.20765. Watch for how the pair responds to 1.20875 area of resistance, by going short to T/P of 1.20450

GBPUSD 2018.01.03

GBPUSD 2018.01.03GBPUSD pair has weakened by the trading into resistance of 1.36120 this morning, considering the price bursting to a new three-month high overnight trading session. With the price consolidating, there was a chance of shorting the pair. However, we did not get filled

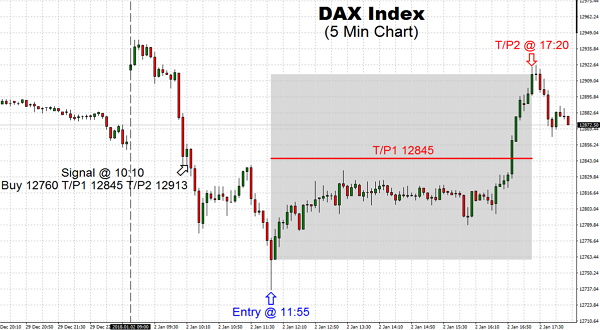

DAX Index 2018.01.02

DAX Index 2018.01.02A continuation of the upward move produced a closure the gap of 12913. The break-out to fresh high ought to be seen as a validation of the robustness of the push, having dip buyers more likely to step in, to keep upward force

GOT SOMETHING TO SAY:

Archives

Charts Of The Day February 2018

Charts Of The Day December 2017

Charts Of The Day November 2017

Charts Of The Day October 2017

Charts Of The Day September 2017

Related Pages

Trading signal service for you!

![]() Curious about online trading? Want to make more money, be highly successful and have positive experiences in the niche? Welcome to TradingSig.com, a website that will...

Curious about online trading? Want to make more money, be highly successful and have positive experiences in the niche? Welcome to TradingSig.com, a website that will...

Live Signal

![]() The Live Signal of TradingSig.com was formed to provide high-quality signal service for the novice, experienced and professional traders. This project started out as a way to...

The Live Signal of TradingSig.com was formed to provide high-quality signal service for the novice, experienced and professional traders. This project started out as a way to...