The price of Bitcoin has soared, sparking the great industry interest

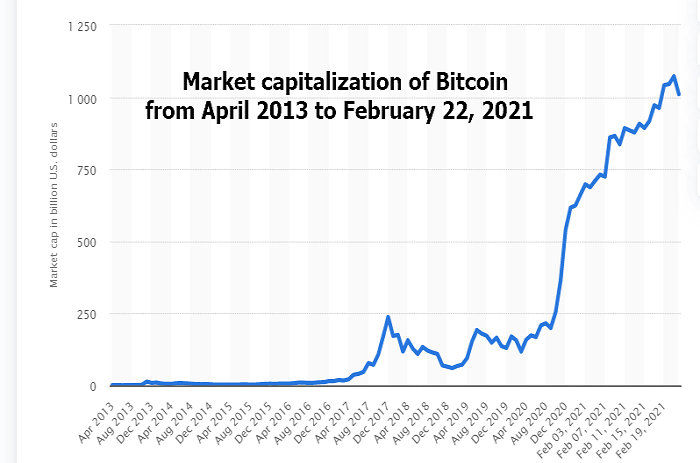

In less than half a year, the price of Bitcoin has more than quadrupled. With this event taking place, the market capitalization has reached over one trillion dollars. This is the first time this market capitalization has reached a value this high - Market capitalization is referred to as the total dollar market value of an asset.

If you wanted to perceive how impressive this is for Bitcoin in terms of numbers, the coin's capitalization was right under 200 million dollars five months ago. To put this market capitalization into perspective, consider companies such as Visa at $430 billion, MasterCard at $343 billion, JPMorgan Chase at $304 billion, PayPal at $228 billion, and Bank Of America at $216 billion.

To interpret what that market capitalization means, the coin is worth more than double what these companies are worth. In some cases, the currency is worth more than triple.

It is momentous when any business reaches a market capitalization of one trillion dollars, and it's no different for Bitcoin. This was a buzzing effect for a while by the Blockchain community. The real result is that traditional undertakings are now designating a part of their treasury to Bitcoin and accepting it as a payment form.

No one was expecting Bitcoin to grow at the speed that it has. That's why so many people are talking about the coin price explosion. Many people are trying to explain this unexplained growth and predict whether or not the development will be enjoyed in the future.

Is Bitcoin is an economic bubble?

There are people saying Bitcoin is just an economic bubble. However, those same people say that with things like Bitcoin, credit card companies and banks have to choose a higher rate of return on their money because they won't get the same return on other assets or as they would from bonds.

Other people are claiming accepting the coin is a way to fight off inflation. Bitcoin is being compared to a digital version of Gold because only a limited amount exists. In the entire world, there are 21 million Bitcoins in existence.

Notwithstanding, one difference between the coin and other assets is that over half of the trades involving the digital currency are caused by HFT (High-Frequency Trading) algorithms. The High-Frequency Trading algorithms are designed to scalp profit within small moves in the price of the coin. These programs are a significant source providing value to the crypto coin market never the less.

Most people may not know that 50 to 60% of all trades involved in Bitcoin moved in and out their money from cryptocurrency to U.S. dollar stablecoin Tether (USDT) and from Tether back to cryptocurrency.

The future of Bitcoin

Time will tell if governments worldwide will restrict or forbid people from using Bitcoin or other cryptocurrencies. Many governments in the world look at crypto coins as severe competition to their money. Will the governments that share this viewpoint retaliate against the currency in some way? If governments try to go against it, will they do something that will negatively impact the coin's value?

The uncertainty of Bitcoin that many people do not realize is that the government will not concede to the competition. Once it gets to the point where the government has to do something, they will seize all the cryptocurrencies and provide the masses an official exchange rate swap, and they will determine the price. Then, you will receive the official central banker's digital currency.

We also have to look at how the inflation of the dollar will affect the coin. This, without a doubt, will hurt people. The United States government has been printing money out of thin air for some time now, and the world reserve currency won't be worth that paper it is printed on if this continues.

The Federal Reserve claims that the total amount created since February of last year is three and a half-trillion dollars. Thanks to lockdowns lasting for months and other poor government choices when reacting to the COVID-19 fake pandemic.

As an example, let's look at the next proposed stimulus package. It will cost almost two trillion dollars, and when money like that is created with nothing behind it, it will devalue the US dollar even further. We won't notice it right away, but that doesn't mean it wouldn't happen ultimately.

What effect would those events have on Bitcoin? Will people continue using it as a hedging strategy? Will people be investing their money in more conservative assets? Only time will provide the answers to these questions.