The Impact of Artificial Intelligence on Energy Infrastructure

Authored by: Brad Thomas

You live in Virginia. Northern Virginia, to be exact. Loudoun County, probably. I don't mean physically, of course. You could be anywhere in the world for all I know.

But your online identity? Your photos? The words you're reading right now? That song you're streaming in the background?

There's a good chance that a big chunk of that is coming to you from a data center in Northern Virginia. People must learn how much of the world's internet data flows through Virginia. But it's a lot. Estimates range from 30% to 70%.

That's because Northern Virginia has the world's highest concentration of data centers. And most of them are in Loudoun County.

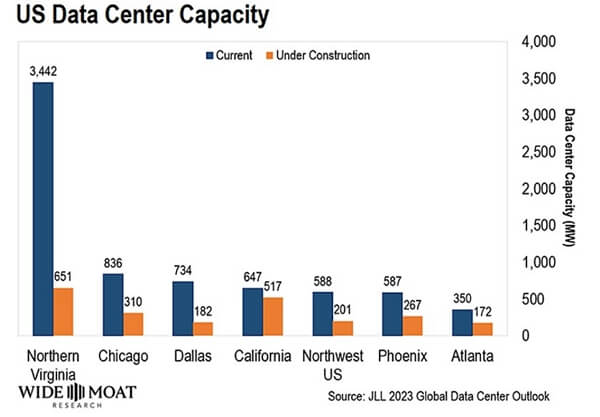

A recent real estate services company, Jones Lang LaSalle report, estimates 3,400 megawatts of data center capacity in Northern Virginia. That uses enough electricity to power over 2.5 million homes. It's three times larger than Singapore's next biggest data center hub.

Companies love putting data centers in Virginia for several reasons. It has blazing-fast internet connections, few regulations, and generous tax benefits. It also has mild weather and few natural disasters.

And most important of all, it has cheap and abundant power. It had reasonable and great energy.

Because the data centers in Northern Virginia are running into a big problem: They can't get enough electricity to run their computers…

My primary focus is on finding the safest income investments on the market. When significant trends happen in an industry, we pay attention… and look for ways to profit.

The Data Center Power Problem

Virginia is one of many places with power problems. Data centers nationwide and in Europe face similar issues connecting to the grid.

It all boils down to one word: transmission. Electricity produced at a power plant has to flow through a network of power transmission lines before it reaches homes and businesses where it is used.

But each power line can only handle so much electricity. If it gets overloaded, the massive amount of heat from electricity flowing through can melt the wire.

That's the problem data centers are running into. There needs to be more power being produced. There aren't enough transmission lines to safely deliver the electricity to where it needs to go.

America's aging power grid wasn't built to handle the large amounts of electricity we demand now.

And the problem will grow as companies start using artificial intelligence, which requires much more computing power.

Asking ChatGPT questions takes 3 to 30 times more energy than a Google search. Garter estimates that half of all cloud data centers will use artificial intelligence by 2025.

Despite the problem of needing more power in certain places, data center construction is still booming. More than 2,300 megawatts of data center capacity is under construction across the U.S.

That means plenty of future demand for power transmission to catch up with.

The federal government is well aware of the transmission bottleneck and is trying to help. The Department of Energy has $13 billion in grants and funding from the infrastructure bill to help modernize and build out the country's power transmission network. That money will flow to one sector…

How We'll Profit From This Problem

This all adds up to a golden opportunity for utility companies to build more transmission infrastructure.

Since most utility company earnings are regulated based on the infrastructure assets they own – and not the amount of electricity they deliver – building large power transmission projects will boost their profits for years to come.

One easy way to add utility companies to your portfolio is through the Utilities Select Sector SPDR Fund ETF (XLU).

This ETF holds a basket of the largest utility companies in America. The same companies will be called on to fix this problem. And right now, XLU yields 3.29%. You can also profit from this current trend with one of my favorite plays in the market.

I call it "Amazon's Secret Royalty Program." And it shows how to set up a royalty-like income stream from the growing demand for data centers – like the ones in Northern Virginia.

And even better, I just revealed our favorite mission-critical utility company trading at a discount for those who decide to become members. It'll benefit from plugging the data transmission demand gap.

It yields 4.3% and has grown its dividend 18 years in a row. During that time, it has returned 53% more than XLU. With government funding and continued growth, it's likely to continue beating those returns.

This growing demand for new transmission infrastructure will be around for a while. And we can profit from it for years to come.

Happy SWAN (sleep well at night) investing,

This article was printed from TradingSig.com